Bank deposit ranking (?7.6%) | June 2025

Looking for a deposit that will give you the most bang for your buck in June? Great! We’ve prepared a list of the best deposits offered by banks for June 2025. To help you make an informed choice, the list also includes a comparison of the deposit offer with the ranking of savings accounts.

How was the ranking of the highest interest-bearing deposits for June 2025 created?

Each of the deposits included in the ranking is covered by a deposit guarantee up to a certain amount.

Some offers are available in both short- and long-term versions, as reflected in the tables, but we focused on the interest rates available for the variants that match each comparison. Interest rates are also the main criterion we used when ranking each deposit. It is also important to remember that the rates quoted are annual rates and therefore do not reflect the profits achieved on shorter-term deposits.

SHORT-TERM DEPOSIT RANKING – JUNE 2025

Welcome to Nest Bank deposit: 7.6%

The first place in the short-term deposit ranking was taken by the six-month “Lokata Witam” from Nest Bank with a fixed annual interest rate of 7.6%. Only new bank customers can take advantage of the offer by opening a deposit within one month of opening an account at Nest Bank, settled in PLN.

? Start-up deposit at Alior Bank: 7%

Second place was taken by “Lokata na start” from Alior Bank, offering an annual interest rate of 7%. The promotion is valid for 90 days, after which the interest rate on the deposit drops. This offer is available to those who have not had a checking or savings account with Alior Bank in the last three years.

? VeloBank Active Loan: 7%

Third place is Velolokata for Active People from VeloBank with a rate of 7% per annum (for 6 months). The offer is intended only for new customers who provide marketing consent, open a personal account and meet the condition of regular monthly income of at least PLN 2,000.

Interest rates on short-term deposits – June 2025

Opening a deposit when opening a personal account (maximum 1 deposit, opened within 30 days of opening your first PLN account with Nest). This offer is for new Nest Bank customers. A personal account and activity requirements (e.g., regular deposits) are required to maintain the increased interest rate.

Personal account required.

VeloLokata for Active People is a special savings offer from VeloBank aimed at customers who haven’t used its savings products before. The deposit offers an attractive 7% annual interest rate for six months, with deposits ranging from PLN 1,000 to PLN 50,000. To qualify, you must have a personal account with VeloBank, have regular monthly deposits of at least PLN 2,000, and provide marketing consent. The offer is available until May 15, 2025. Early termination of the deposit will result in loss of interest, and after the term ends, the deposit will automatically renew, but with less favorable terms.

Personal account required (Alior Account or Jakże Osobiste Account)

The deposit must be opened within 14 days of opening the personal account.

The Start Deposit offers a promotional interest rate of 7% per annum for three months, with no card transactions or income required. The deposit is intended for individuals who have not held a personal account with Alior Bank in the last three years. After 90 days, the deposit automatically renews at a lower interest rate.

The security of funds up to 100,000 euros is guaranteed by the German equivalent of the BFG

Breaking the deposit before the agreed date means losing half of the accrued interest.

For new customers only

The Promotional Deposit is an attractive term deposit available as part of the mBank personal account promotion. The annual interest rate is 7.2% for mKonto Intensive holders and 7% for eKonto do usług, with maximum deposit amounts of PLN 50,000 and PLN 25,000, respectively. The deposit term is three months.

A deposit with a promotional interest rate can be opened within 30 days of opening a personal account at mBank.

No need to open a personal account

The offered annual interest rate is 6.2%, and the deposit is available in 3- and 6-month variants, offers one of the highest maximum deposit amounts on the list and does not require us to open a personal account at HoistSpar bank (an account on the Raisin platform is sufficient).

Requires completion of formalities allowing for taxation of interest according to Polish regulations (19% vs. 25% according to Austrian law)

The Facto Deposit is a savings product offered by the Polish branch of BFF Bank SpA. It allows you to multiply your capital with interest rates of up to 5.5% per annum. The minimum deposit amount is PLN 5,000, and the term can range from 1 to 60 months. An additional benefit of the Facto Deposit is the absence of additional fees for maintaining the deposit account and making transfers. Funds are covered by a deposit security guarantee up to €100,000.

Inbank offers new customers a 3-month Start Deposit with a 5% annual interest rate. You can deposit up to PLN 50,000 without having to open a personal account. This offer is only available to those who haven’t previously held a deposit with Inbank. Simply open an online deposit and deposit the funds within 5 days. Terminating the deposit early will result in forfeiture of the interest. After the deposit expires, it can be automatically renewed with an additional 0.1% interest bonus.

Estonian Inbank offers customers a fixed annual interest rate on its standard term deposit account, depending on the term. The 6- and 12-month options offer a top rate of 5%. Although the deposit limit is only PLN 50,000, Inbank has not set any limits on the number of deposits a single customer can open, and in total, they can deposit up to PLN 1 million.

Breaking the deposit before the due date results in loss of interest.

The New Funds Online Deposit is an offer for those looking to invest surplus funds on favorable terms. The interest rate is up to 4.5% per annum (for 3- and 4-month deposits), and funds can be deposited for periods from 1 to 36 months. The deposit is only available for new funds, meaning surpluses over existing deposit balances with Santander Consumer Bank as of February 10, 2025. You can take advantage of this offer by opening an online deposit. A personal account is not required.

The Euro deposit offered by Inbank is the only option in the ranking for those looking to grow their euro savings. The product features a fixed interest rate, depending on the selected deposit term (from 3 to 12 months). Profits accrue without the need to meet additional terms and conditions, and the deposit process itself is fully online. The security of your funds is guaranteed by the Estonian Guarantee Fund, which protects deposits up to €100,000 per person.

LONG-TERM DEPOSIT RANKING – JUNE 2025

The long-term deposits list includes three options. The highest rate is offered by the Lokata 5 Plus from Volkswagen Bank, offering an annual interest rate of 5.5% (the Lokata 5 Plus term can range from 1 to 10 years).

The term can range from 1 to 10 years. The minimum deposit amount starts at PLN 1,000, and in the event of early termination, the bank guarantees payment of half the interest.

Aion Bank offers a term deposit with a fixed interest rate of 5.2% per annum. Deposits can be made for a period of 12 months, and there is no minimum amount specified – customers can deposit any amount up to PLN 1,000,000. The deposit is available to both new and existing customers, but opening one requires an Aion Easy personal account. Deposits are opened via the bank’s app.

If the deposit is terminated prematurely, the client loses the accrued interest. Deposited funds, up to the equivalent of €100,000, are protected by the Belgian Guarantee Fund.

Deposit opened online

Inbank offers fixed interest rates ranging from 3% to 5%, depending on the selected term – from 1 month to 5 years. The maximum deposit amount per deposit is PLN 50,000, but clients can have multiple deposits, up to a total of PLN 1 million. This offer is available to new and existing clients. Deposited funds are covered by an Estonian guarantee up to EUR 100,000. The bank does not pay interest in the event of early termination of the deposit.

Average interest rates on deposits by duration

The chart shows that deposits with terms of 3 and 6 months offer the highest interest rates, at 5.77% and 5.44%, respectively. Deposits with terms of 12 months and longer offer average rates of 4.24% and 3%. We can also see a decline in average rates compared to the previous month’s ranking .

Term deposits vs. savings accounts: comparison of offers from rankings as of June 2025

If we compare the rates in the deposit ranking with the interest rates on savings accounts in the second ranking, we find that these accounts offer slightly higher interest rates—6.32% for accounts and 5.64% for deposits. However, this is due to promotional rates set by banks to attract customers. These rates are time-limited and subject to certain conditions.

When we compare the annual interest rate on deposits with standard rates on savings accounts, the situation looks completely different. Deposits offer an average rate of 5.64%, while savings accounts offer customers just over 1.4%.

Apart from the promotion, the choice between a deposit and a savings account is primarily a choice between a higher profit achieved at the expense of freezing money for a longer period in a deposit, and the flexibility of a savings account.

Deposit interest rates will fall in 2025: after the last NBP cut, the market expects further cuts

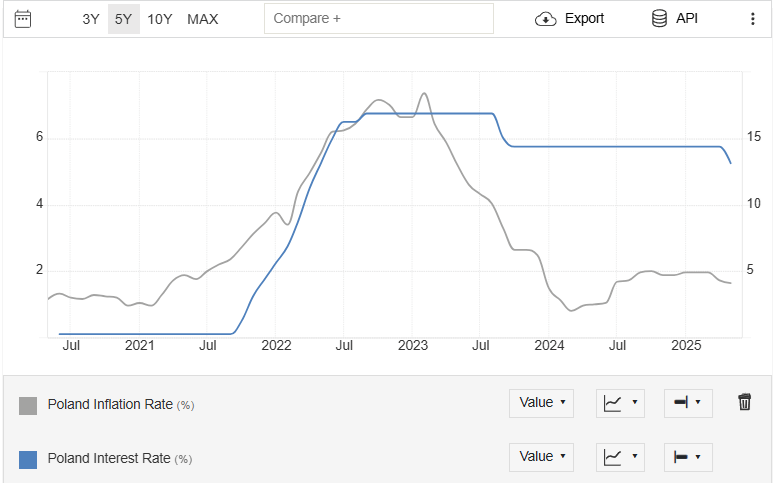

The interest rate on bank deposits and savings accounts in Poland is directly linked to the level of interest rates set by the Monetary Policy Council ( high rates favor more attractive interest rates on deposits ).

At its May meeting, the Monetary Policy Council (MPC) decided to cut interest rates for the first time since October 2023. The cut amounted to 50 basis points , meaning the NBP reference rate now stands at 5.25% and the deposit rate at 4.75%. This marked the end of a period of rate stabilization that had lasted over a year.

The decision didn’t come as a surprise to the market – most economists had expected such a move. Now, attention is shifting to the coming months, and analysts are increasingly convinced that this is the beginning of a longer cycle of monetary policy easing. Some – like Goldman Sachs analysts – expect rates to remain at their current level in June and another cut in the third quarter.

Chart of inflation and interest rates in Poland. Source: Tradingeconomics

Preliminary estimates from the Central Statistical Office indicate that CPI inflation in May reached 4.1%, a 0.2% decline compared to April. Core inflation also continues its downward trend – Pekao economists estimate that it reached only 3.3% in May. Commenting on this data, economists from Pekao Bank predict that CPI inflation could reach the National Bank of Poland’s (NBP) inflation target of 2.5% as early as the third quarter and remain close to it until the end of the year. If these scenarios materialize, the Council may continue cutting interest rates – further decisions will most likely depend on the publication of the new inflation projection in July.

The current high interest rates have fostered attractive interest rates on bank deposits. However, as the cycle of rate cuts begins, banks will begin to adapt their offerings to market conditions, meaning rates on new deposits may gradually decline.

FAQ

Jakie lokaty są najlepsze na czerwiec 2025?

Nest Bank currently offers the highest interest rate among short-term deposits: 7.6%. The long-term deposit with the highest rate is the 5 Plus Deposit at Volkswagen Bank: 5.5%.

Lokata a konto oszczędnościowe - co wybrać?

A term deposit often offers higher interest rates but locks your funds in for a set period of time, while a savings account is more flexible and offers access to your money at any time, at a lower rate. So, the choice depends on whether your priority is maximizing your returns or the freedom to use your savings .

Jak jest najlepsza lokata bez konta na czerwiec 2025?

The highest interest rate deposit that does not require opening a personal account is the HoistSpar Deposit available through the Raisin platform: 6.7%.

Czy mogę wcześniej wypłacić pieniądze z lokaty?

In most cases, early termination of the deposit means loss of interest.

Jak w Polsce opodatkowane są odsetki z lokat?

In Poland, the interest you earn on your deposit will be reduced by 19%, which will be paid to the State Treasury. This tax is known as the Belka Tax.

Czy lokaty są bezpieczne?

Deposits in Polish banks are among the safest ways to invest, as they are covered by the Bank Guarantee Fund’s deposit guarantee of up to €100,000 . Therefore, the risk involved is minimal. However, in the case of deposits in foreign banks, if they are covered by the deposit guarantee provided by the country’s equivalent of the BFG, the funds are also protected, although the recovery process may take longer.

Czy mogę założyć lokatę przez internet?

Yes, most banks allow you to open deposits online. You can do this through their online banking system or mobile app.