Commission-Free Passive Investing and 3 ETFs Worth Knowing

Since the early 1990s, ETFs have been gaining popularity as one of the simplest ways to invest in stock markets. We explain how they work, present examples of interesting ETFs, and show you how to start investing in them.

ETFs and their advantages over traditional investing

The acronym “ETF” stands for “Exchange-Traded Fund,” which literally means an investment fund listed on a stock exchange. This instrument is a basket of various assets, which may include stocks, bonds, commodities, and, more recently, cryptocurrencies (the first cryptocurrency ETF, the ProShares Bitcoin Strategy ETF, was approved by the SEC in 2021).

We can buy and sell such funds in real time from the brokerage platform, just like in the case of shares. Like some companies, some ETFs also pay dividends (so-called distribution funds) – although we can also come across those that, instead of regularly distributing them to unit holders, reinvest them, accelerating capital growth (so-called accumulation funds).

The problem that ETFs solve

The basic problem with investing in individual companies is its difficulty, which is why in the case of individual investors (and not only) it is often ineffective. When selecting assets independently, an investor must build a portfolio by analyzing the risk. It calculates correlations between instruments (a basket of highly correlated shares is associated with higher risk, because a decline in one portfolio component will drag the rest down with it) or distributes capital between them, taking into account their average volatility.

These and many other conditions that we must meet require knowledge and experience that most participants do not have the opportunity, desire or time to acquire.

When investing in an ETF, we are effectively investing in a ready-made, diversified portfolio of assets, created for us by its creators. The knowledge required for such an investment is therefore minimal. Taking the example of S&P 500 ETFs, the issuer, seeking to mirror its performance, purchases the constituent shares in appropriate quantities. At the time of writing, the top three spots in the index are occupied by Nvidia (7.11%), Microsoft (6.35%), and Apple (5.89%). Therefore, an S&P ETF contains these companies in these specific proportions.

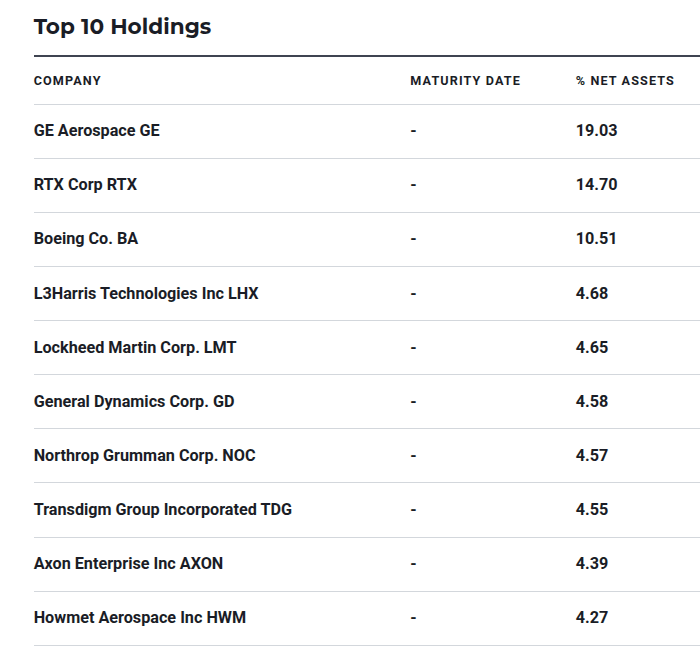

Top 10 stocks with the largest weightings in the iShares US Aerospace & Defense ETF. Source: money.usnews.com

This makes investing in ETFs a popular way to catch trends in entire segments of the economic system. Buying a single, promising company in the technology sector, on the one hand, means the chance for astronomical returns, as in the case of Nvidia. On the other hand, it carries the risk that our pick will fail while the sector in which it operates will, on average, gain significantly in value.

When choosing an ETF or building a portfolio from several different instruments of this type, we choose lower risk and the convenience of passive investing ( but remember that reducing risk through diversification may turn out to be an illusion if the ETF purchased consists of, for example, shares of overvalued companies ).

This convenience, however, has its drawbacks. Popular ETFs typically perform close to the average performance of a specific economic sector or the broader market, so purchasing shares in such a fund shouldn’t result in the spectacular returns sometimes achieved by individual companies.

Therefore, it is a relatively safe style (compared to investing on your own and depending on the ETF chosen), but also a slower way of multiplying capital.

Advantages and disadvantages of ETFs

Advantages:

- Diversification: one purchase – the entire basket of instruments

- Easy accessibility for beginner investors

- Lower costs than actively managed funds

- Buy/sell at any time during the session

- Flexibility: in addition to equity funds, we also offer funds containing bonds, commodities and precious metals

Defects:

- ETF Value Falls with the Market: No Active Management

- Tracking Error: The ETF may deviate slightly from the index it tracks.

- Illiquidity risk: Less frequently traded ETFs may be harder to sell quickly at a good price

- Currency risk: the value of ETFs denominated in currencies other than the currency of our brokerage account may change due to exchange rate fluctuations

ETFs worth considering in 2025

After discussing the basics of how ETFs work, let’s take a look at three funds investing in, among other things, artificial intelligence technology and the defense sector.

AI & Robotics ETF: Global X Robotics & Artfcl Intllgnc ETF (BOTZ)

The first instrument is the Global Robotics & Artificial Intelligence fund, which focuses on companies operating in the artificial intelligence and robotics sector. Its goal is to closely replicate the performance of the Indxx Global Robotics & Artificial Intelligence Thematic Index, which includes companies related to industrial automation, robot production, AI development, and the implementation of autonomous vehicles.

The fund’s annual maintenance cost (Total Expense Ratio) is approximately 0.50%, and the UCITS version for European investors typically pays dividends twice a year. This is an interesting option for those who believe in the long-term trend of automation and AI, but it’s important to remember that technology companies are associated with high volatility.

Companies with the largest share:

- NVIDIA Corp (13.29%)

- Intuitive Surgical Inc (9.03%)

- Dynatrace Inc. (3.98%)

Defense & Aerospace ETF: iShares US Aerospace & Defense ETF (ITA)

ITA is a fund focused on the US aerospace and defense sector. It tracks the Dow Jones US Select Aerospace & Defense Index, which includes manufacturers of aircraft, helicopters, defense systems, and military equipment. It provides investors with exposure to key companies that supply products to both the military and civil aviation sectors.

The fund is denominated in US dollars, dividends are paid quarterly, and the maintenance cost is approximately 0.40% annually. However, it’s important to keep an eye on the geopolitical situation, changes in national budget policies, and government contracts, as these factors, among others, determine the valuations of the companies included in the ETF.

Companies with the largest share:

- GE Aerospace (19.03%)

- RTX Corp (14.70%)

- Boeing Co. (10.51%)

Emerging Markets ETF: iShares Edge MSCI EM ValueFactor UCITS ETF USD (5MVL)

The final interesting option is that of emerging markets. Registered in Ireland, 5MVL, however, approaches these markets selectively, relying on a value investing strategy. This means it invests in companies that are relatively cheaply valued compared to others, taking into account metrics such as the P/E ratio (price-to-earnings ratio) or the ratio of a company’s value to its cash flow. Dividends are not paid, but reinvested, making this a beneficial solution for those who prefer capital accumulation. The holding cost is approximately 0.40% per year.

Companies with the largest share:

- Taiwan Semiconductor Manufacturing Co. Ltd (8.38%)

- SK Hynix Inc (4.21%)

- Hon Hai Precision Industry Co Ltd (3.37%)

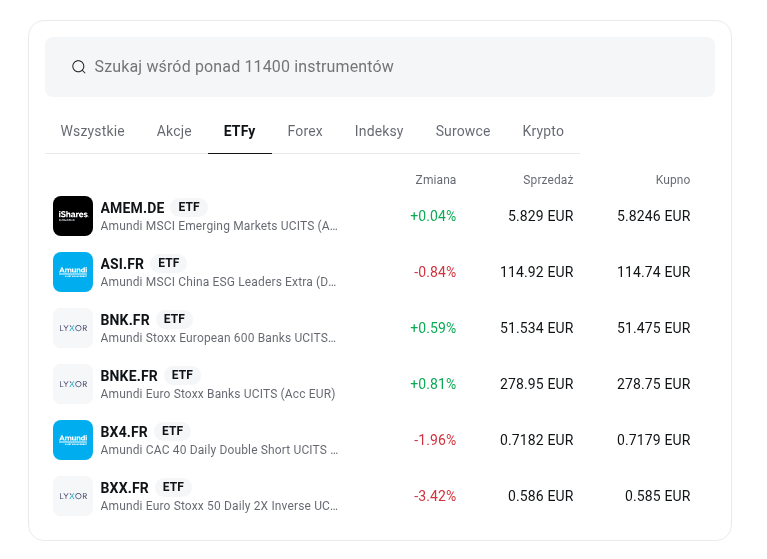

ETF fund offer on the XTB platform

One of the brokers operating in Poland that allows investing in ETFs is XTB. The platform offers over 1,600 instruments in this class and allows the purchase of both CFDs on ETFs intended for speculators and real funds. This means that after purchasing, the client becomes the beneficial owner of the units. Investing in ETFs is commission-free up to a monthly turnover of €100,000 , and above this amount, the broker will charge 0.2%.

However, if the ETF you purchase is quoted in a currency other than the currency of your account, you will pay 0.5% for currency conversion.

Source: XTB

The platform also has a dashboard that allows you to scan the market for funds that suit you, as well as the option of automatic, cyclical investing in selected ETFs in accordance with the portfolio proportions you have set.

How to start investing in ETFs on XTB without commission?

If you want to invest in ETFs on the XTB platform, you need to follow two simple steps.

Step 1: Opening a brokerage account and verification

If you don’t already have an account with XTB, visit the broker’s website or launch the mobile app and select “open an investment account .” You’ll need to provide your personal information and then complete KYC verification by submitting an ID card or passport.

After successful verification, you must top up your account with one of the accepted currencies (PLN, EUR, USD).

Step 2: Buying an ETF

Use the search engine or the platform’s ETF scanner to find funds covering the sectors, regions, or investment styles you’re interested in. Then, select an instrument and, in the order submission panel, enter the number of units you want to purchase (XTB allows you to purchase whole or fractional units) and complete your purchase.

FAQ

Czym są fundusze ETF?

ETF, czyli “Exchange Traded Fund” to rodzaj funduszu notowanego na giełdzie, czyli gotowego portfela inwestycyjnego, przeważnie składającego się z koszyka różnych instrumentów (takich jak akcje, obligacje czy metale szlachetne i surowce). Jednostki ETF można kupować i sprzedawać podczas trwania sesji giełdowej dokładnie tak, jak w przypadku akcji.

Czym ETF-y różnią się od inwestowania w pojedyncze akcje?

Inwestując w akcje pojedynczej firmy, uzależniasz wyniki swojego portfela od jej kondycji. ETF daje Ci udział w całym zestawieniu wielu akcji spółek (lub innych aktywów), często według składu określonego indeksu, co pozwala ograniczyć ryzyko - jeśli jedna spółka zawiedzie, inne mogą zrównoważyć wygenerowaną przez nią stratę.

Jak ETF-y pozwalają na łapanie trendów w całych sektorach rynku?

ETF-y są dobrym narzędziem do ekspozycji na trendy, bo mogą dawać dostęp do całych segmentów wybranego rynku. Jeśli zakładasz silny rozwój np. sektora AI czy zielonej energii, zamiast selekcjonować pojedyncze spółki, możesz wybrać ETF, który skupia najważniejsze firmy z tych obszarów i dzięki temu “podłączyć się” pod ten trend.

Czy zapłacę w Polsce podatki od inwestowania w ETF-y?

W Polsce dochody z ETF-ów, podobnie jak dochody z innych papierów wartościowych, muszą być wykazane w deklaracji PIT-38 i podlegają podatkowi od zysków kapitałowych (podatek Belki) w wysokości 19%.