ETC and Mining Stocks – Easy Ways to Invest in Gold

Gold is an immortal store of value. Furthermore, due to its high volatility, it’s also a favorite asset for day traders. ETCs allow both long-term investors and those who enjoy spotting local trends to easily gain exposure to the precious metal’s price. How does it work, and how can you start investing in it?

Gold as a classic instrument protecting against inflation

In the world of economics, gold is viewed as a so-called safe haven instrument, most often used by investors to protect their funds against inflation.

However, its application can be much broader.

This metal is independent of the monetary policies of individual countries and responds to changes in the global economic and geopolitical context : from financial crises to tensions between countries – often gaining value in periods of uncertainty.

Investors can capitalize on these fluctuations not only by purchasing physical gold, but also through indirect exposure: for example, by purchasing shares of mining companies whose prices correlate with gold or by purchasing gold-based ETFs. These types of gold investments offer greater flexibility, allowing us to benefit not only from long-term price increases but also from short-term fluctuations.

In addition to ETFs and shares, an instrument that offers this possibility is ETC.

How do ETCs work?

ETC, or “Exchange Traded Commodity”, is a financial instrument listed on the stock exchange that allows investors to gain exposure to the prices of individual commodities or baskets of commodities without having to own them in physical form. They are usually based on futures contracts, but in some cases they are secured by a physical commodity (e.g. gold, silver or crude oil).

In this way, from a legal perspective, an ETC is a debt owed by the issuer to the investor (meaning it operates completely differently from ETFs) . This is crucial because, even though ETCs are secured by futures contracts or physical commodities, we still have to consider the issuer’s credit risk. If the issuer experiences financial difficulties or becomes insolvent, in some cases it may not be able to pay us the current value of the commodity.

ETC vs. Physical Gold and CFDs and Futures

Investing in gold through ETC has several significant advantages.

Unlike physical gold, it does not require transportation and storage costs, and ETCs can be backed by real gold stored by the issuer. Their advantage over CFDs (contracts for difference) is greater transparency and the absence of overnight holding costs. This makes ETCs better suited for long-term investing.

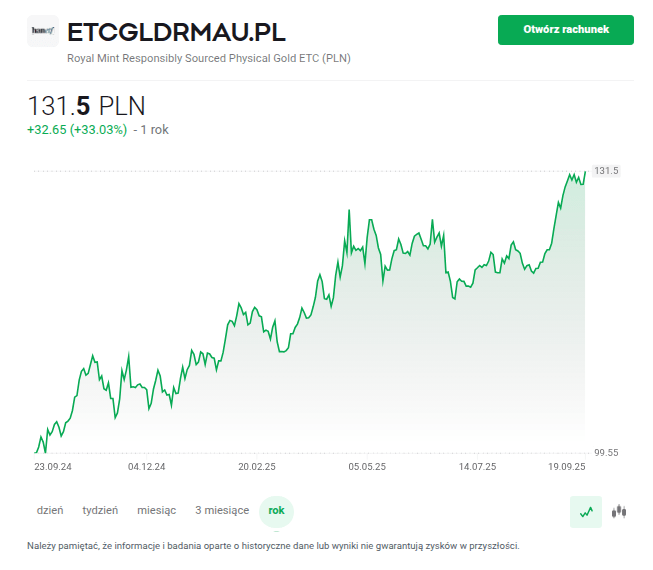

ETC gold chart on the XTB platform. Source: XTB

Compared to futures contracts, they are more readily available to individual investors. They are not leveraged and do not require contract rollovers or active position management.

All this makes them a flexible, liquid and relatively simple tool for gaining exposure to gold price fluctuations – even suitable for beginners.

Advantages and disadvantages of investing in gold through ETC

Advantages:

- Easy availability: listed on the stock exchange and available for purchase/sale at any time during the trading session

- Possibility of securing with physical gold

- High liquidity: especially for popular ETCs

- Low cost: no insurance or physical storage required

Defects:

- Issuer credit risk: the possibility of losing some or all of the capital in the event of insolvency

- No physical gold possession

- TER (Total Expense Ratio) fees: in the long run they reduce the value of your investment

- Belka Tax: ETC profits are taxed at 19%

- High volatility of gold prices

Investing in gold through correlated companies

In addition to investing in ETCs, exposure to the gold market can also be gained by purchasing shares of companies that are strongly correlated with the price of the metal. Below are three examples of such companies operating in the mining sector.

Newmont Corporation (NYSE: NEM)

Newmont is the largest gold producer in the world, operating on several continents: North and South America, Australia and Africa. The company has a broad portfolio of mines, which allows it to maintain stable production and limit the impact of problems at individual locations. Thanks to its global scale and cost management expertise, Newmont is one of the main beneficiaries of rising gold prices, and its shares often react strongly to price movements in this market.

Barrick Mining Corporation (NYSE: B)

Barrick Gold is another of the world’s largest gold producers, with an extensive portfolio of assets spanning 18 countries, including the United States, Argentina, Canada, Chile, the Democratic Republic of Congo, Ecuador, and Pakistan. In addition to gold, the company also mines copper, which increases in price during periods of economic expansion , providing partial diversification and additional revenue.

Wheaton Precious Metals Corp. (NYSE: WPM)

Unlike the two previous companies, Wheaton does not directly operate its own mines, but rather enters into agreements with precious metals producers, granting it the right to purchase a portion of their production at a predetermined price. This model allows the company to benefit from rising gold prices while simultaneously mitigating the operational risks associated with mining . Currently, the company has a portfolio of such agreements, encompassing 22 operating mines and 24 projects in development, investing in silver, palladium, and cobalt in addition to gold.

Wheaton is often seen as a more stable alternative to traditional mining companies, while maintaining a strong correlation with the gold market.

ETC and CFD on gold as attractive instruments for day traders

While gold is seen by investors as a hedge in times of economic uncertainty and a refuge from declining purchasing power, it is highly volatile in the short term – much like related companies such as Newmont.

Thanks to this, this metal and the instruments that correlate with it are among the favorite markets of day traders, who make money during a single session on small price movements.

ETC gold offers easy access to this market during trading hours – the instrument is traded like a regular stock, and transactions are settled immediately. This allows traders to open dozens of positions in just a few hours, capitalizing on short-term trends.

However, if the chosen ETC has too low liquidity and wide spreads, investors can turn to gold CFDs, which are available almost 24 hours a day and allow you to open both long and short positions with financial leverage (remember that trading with leverage means higher risk and can lead to quick losses).

How to start investing in gold ETC commission-free at XTB?

XTB is a broker that offers products enabling investment in gold in the form of:

- ETCs – e.g. Royal Mint Responsibly Sourced Physical Gold ETC (PLN) backed by physical gold bars

- Shares of mining companies (the platform includes, among others, three companies from this article)

- CFDs

- ETF funds

Investments in ETCs and ETFs with a monthly turnover not exceeding EUR 100,000 are commission-free.

Step 1: Create an account on the platform and complete KYC verification

The first step to investing in gold-related instruments at XTB is to open an account on the platform . To do this, visit the broker’s homepage or open the mobile app and select “Open an account.” After providing your personal information, you’ll need to verify your identity by submitting the required documents, and then top up your account with funds in an accepted currency (in addition to PLN, these include EUR and USD).

Step 2: Buying ETC for Gold

In the search bar, enter the ticker of the instrument you’re interested in. For gold ETCs, it might be ETCGLDRMAU.PL, for example, or for companies, one of the tickers from our list. After selecting the asset, select the amount you want to purchase in the order placement panel, and then click the “Buy” button.

Czym jest ETC na złoto?

ETC (“Exchange Traded Commodity”) na złoto to instrument finansowy notowany na giełdzie, odzwierciedlający cenę złota. Inwestor, kupując ETC, nie posiada fizycznego złota, lecz nabywa papier wartościowy emitowany przez instytucję finansową, którego wartość rośnie lub spada wraz z ceną kruszcu. ETC mogą być zabezpieczone złotem fizycznym lub kontraktami terminowymi.

Czym ETC na złoto różni się od fizycznego złota?

Główna różnica polega na formie posiadania i sposobie inwestowania. Złoto fizyczne wymaga przechowywania, transportu i ubezpieczenia, podczas gdy ETC umożliwia ekspozycję na złoto bez konieczności magazynowania kruszcu.

Czy zapłacę w Polsce podatki od inwestowania w ETC na złoto?

Tak. Inwestowanie w ETC podlega w Polsce podatkowi od zysków kapitałowych (tzw. „podatek Belki”) w wysokości 19% od zysków osiągniętych ze sprzedaży instrumentu.