IC Markets (IC Trading) is an Australian broker well-known in Europe. Established in 2007, IC Markets has offered its services using an ECN model since its inception. It is regulated by the Australian Securities and Investments Commission (ASIC), the European Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority of Seychelles. The broker prides itself on lightning-fast order execution. Additionally, it offers accounts for scalpers, day traders, and EAs.

In 2023, a new brand was created – IC Trading – to replace IC Markets Global. The broker’s offerings remain the same.

For some time now, it has also been very popular among traders from Europe, who take advantage of the fact that it is not restricted by European financial regulations .

However, it’s important to remember that Australia has introduced restrictions similar to those in force in the Old Continent. IC Markets responded to the new regulations reducing maximum leverage by establishing Raw Trading Ltd., registered and regulated in the Seychelles, where similar restrictions do not apply.

International Capital Markets Pty Ltd (ACN 123 289 109) (trading as IC Markets) is licensed by the Australian Financial Services Licence (AFSL No. 335692).

IC Markets (EU) Ltd – is regulated by the Cyprus Securities and Exchange Commission (CySEC) under CIF license No. 362/18.

Raw Trading Ltd (IC Markets SC) – is regulated by the Financial Services Authority of Seychelles with Securities Dealer Licence number: SD018

Raw Trading (Mauritius) Ltd is regulated by the Financial Services Commission of Mauritius (FSC). License number: GB21026834.

Contents:

IC Markets (IC Trading) offer

IC Markets is a typical CFD broker, meaning that all the instruments and markets it offers are derivatives. When we trade gold, for example, we are not purchasing the physical commodity or a futures contract for that commodity, but merely betting on the increase (or decrease) in its price.

IC Markets currently offers over 60 currency pairs, 25 stock indices, over 20 CFDs on commodities and raw materials, 2,100 shares from the largest markets with the possibility of receiving dividends, a dozen different instruments on the bond and futures market, and over 20 of the most popular digital assets.

Forex

Like other brokers, IC Markets offers access to currency pairs, specifically over 60 different pairs . Spreads on these pairs, according to the broker, start at 0 pips (depending on the account).

For currency pairs, IC Markets clients can access leverage of up to 500:1 ( IC Markets SC clients only, European clients registered under a Cypriot license 30:1; unfortunately, IC Markets does not allow Polish clients to register under the jurisdiction of the Seychelles ) and trade 24 hours a day, 5 days a week. The current list of available instruments and spreads by account type is available here .

IC Markets offers Forex traders some of the tightest spreads of any Forex broker globally, with the EUR/USD spread averaging 0.1 pips. These tight spreads make IC Markets a good choice for active intraday traders and those using Expert Advisors (EAs).

Indexes

Stock market indices offer exposure to baskets of shares from various markets and industries. The most popular include the SP 500, DAX, and FTSE 100. IC Markets offers 25 indices from stock exchanges around the world , which can be traded from three different platforms.

Maximum leverage for indices is 1:20 (1:200 for clients registered under a Seychelles license, not the Polish one), spreads start from 0.4 pips, and the broker does not charge additional commissions. A full list of instruments and spreads can be found here .

Raw materials and commodities

Energy commodities, agricultural commodities, and precious metals. CFDs on these types of products are also available at ICM. Over 20 instruments of this type are available.

The maximum leverage is 1:20 (for precious metals) or 1:10 (for commodities) (1:500 and 1:100 for SC respectively), spreads start from 0 pips, and instruments include oil, coffee, wheat, gold and silver.

Shares at IC Markets

The broker offers access to over 2,100 CFDs on shares and ETFs from exchanges such as ASX, Nasdaq and NYSE. These are contracts for shares of the most popular companies with the greatest liquidity, and investors have the opportunity to receive dividends.

The stock is available exclusively on the IC Markets MetaTrader 5 platform , which offers advanced features for both new and experienced traders looking for advanced analytical tools.

Trading conditions for individual markets will vary. These are detailed on the broker’s website , which also highlights all available instruments. Trading can be performed with leverage up to 5:1.

Bonds

Bond CFDs allow you to gain exposure to national bonds from major countries such as Japan, the UK or the US. In total, you can trade 9 different bonds with leverage up to 200:1. The list of available bonds is subject to change.

Futures

Futures CFDs allow you to gain exposure to the most popular futures contracts, including:

- ICE Dollar Index Futures

-

CBOE VIX Index Futures

-

Brent Crude Oil Futures

-

WTI Crude Oil Futures

As with the other instruments described above, IC Markets also offers a maximum leverage of up to 1:200 (1:5 in Europe) for the CFD futures market.

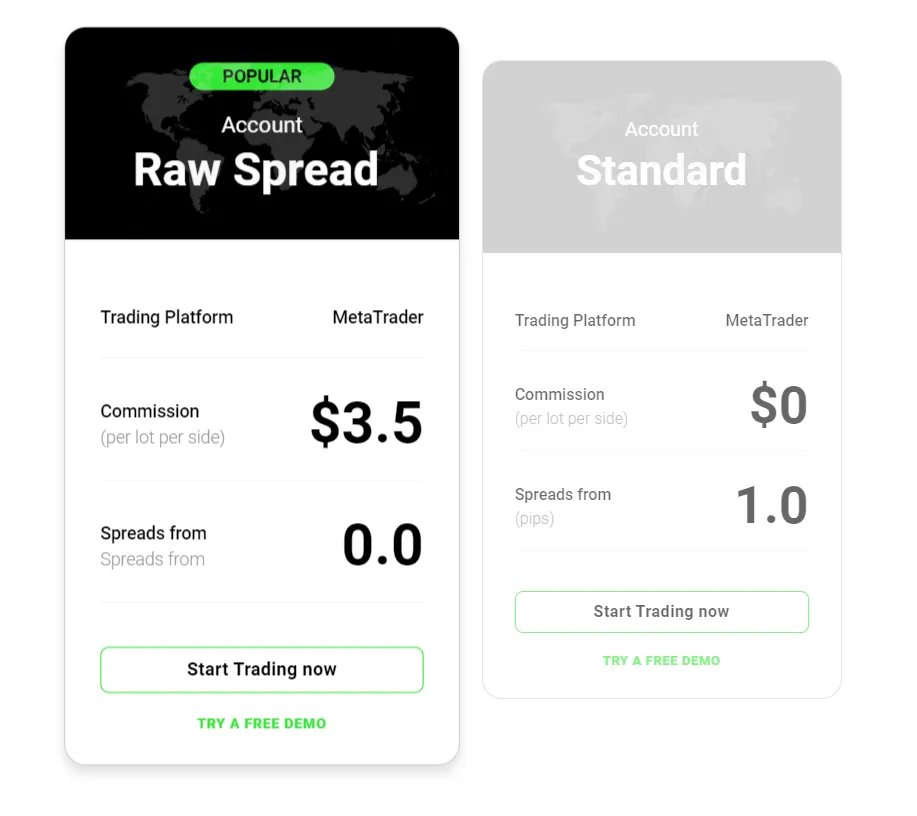

IC Markets Account Types

There are two types of ICM accounts – Raw Spread and Standard. It’s worth noting that leverage depends on the jurisdiction in which the account is opened. While in Mauritius it can be as high as 500:1, in the Cypriot branch of IC Markets it will be compliant with ESMA restrictions, i.e., 30:1 for non-professional clients and 200:1 for professional clients. Similar leverage restrictions will apply to clients opening an account under Australian regulation.

Account Types Offered by IC Markets / IC Trading

- Standard Account – This is a standard account, comparable to those offered by most FX/CFD brokers. The only transaction fee is the spread, which starts at 1 pip . There is no additional commission, as with a Raw Spread account. The minimum lot size is 0.01. Available platforms include Meta Trader 4 and 5.

- Raw Spread Account – This is an account with very low spreads ( the average spread on EUR/USD according to the broker is 0.1 pips ), but with an additional commission on concluded orders ($3.50 per 1 lot of trade, both when opening and closing a position) . Available platforms are Meta Trader 4 and 5.

The broker encourages opening a Raw Spread account, arguing that it offers access to 25 institutional-grade liquidity providers, allowing you to avoid unnecessary delays in order execution.

| Platform | Raw Spread (MetaTrader) | Standard (MetaTrader) |

| Commission (per flight) | $3.50 ($7 round trip) | $0.0 |

| Spreads from (pips) | 0.0 | 1 |

| Initial deposit (USD) | $200 | $200 |

| Maximum leverage | 500:1 | 500:1 |

| Maximum number of orders | 200 | 200 |

| Server location | New York | New York |

| Micro lot trading (0.01) | YES | YES |

| Currency pairs | 61 | 61 |

| CFD indices | YES | YES |

| Stop Out Level | 50% | 50% |

| One Click Trading | YES | YES |

| Islamic accounts | YES | YES |

| Programming language | MQL4 | MQL4 |

| For whom? | EAs and scalpers | Retail traders |

Own study based on data from the IC Markets website

IC Markets Demo Account

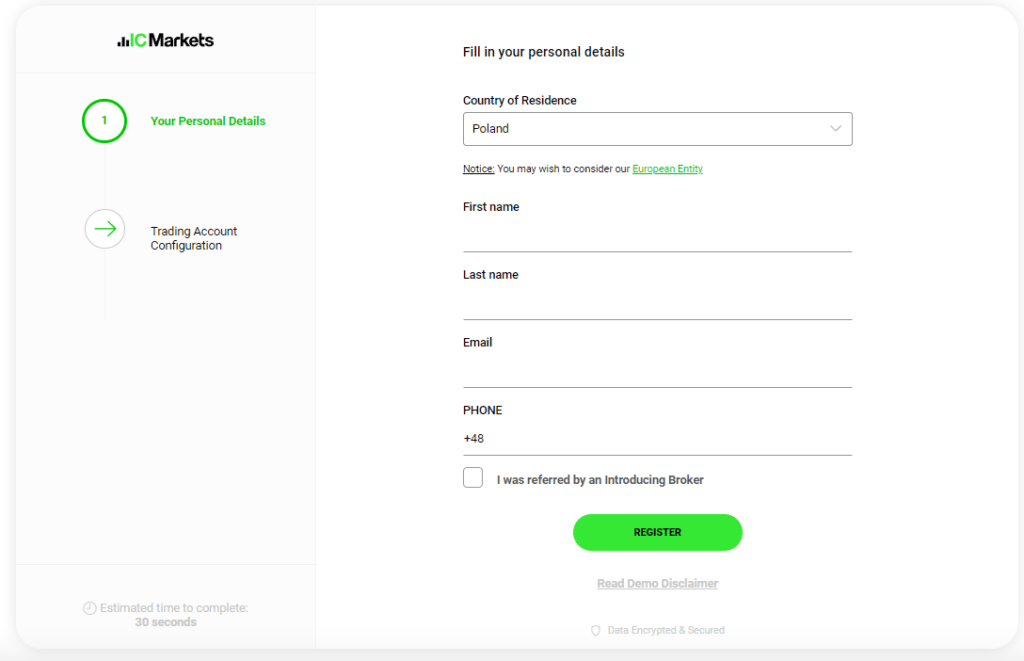

The IC Markets platform allows you to open a demo account . Simply go to the form at https://ictrading.com/en/open-trading-account/demo and provide some basic information:

Demo account registration form. Source: IC Markets

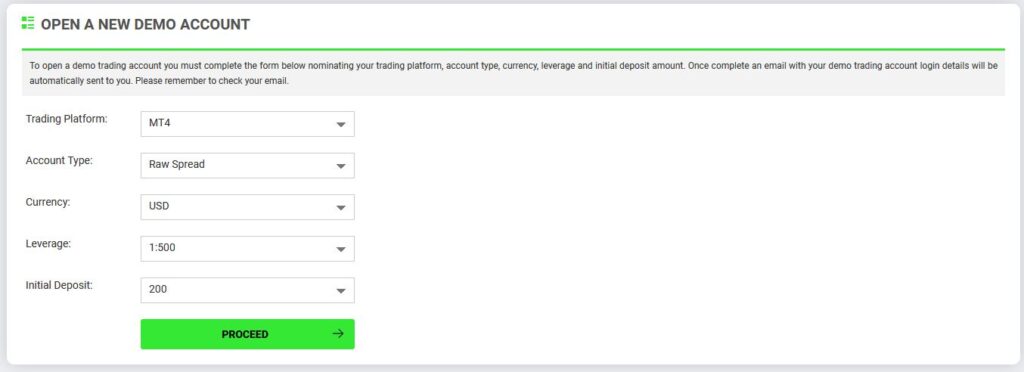

In the next step, you’ll be asked to set up a demo account . You’ll choose the platform you want to use, the type of counter you want to test, its currency, maximum leverage, and initial deposit.

Demo Account Setup. Source: IC Markets

Once you complete these steps, your demo account login details will be sent to the email address you provided during registration. You’ll also receive a link to download the trading platform you selected.

IC Markets Platforms – MetaTrader 4 and 5

The IC Markets broker offers MetaTrader 4 and 5 platforms. The leverage level and available instruments may vary depending on the platform the investor chooses.

Fees and commissions

As mentioned earlier, fees and commissions will vary depending on the selected account and instrument class. IC Markets does not charge any additional fees for deposits or withdrawals , although these may be charged by the bank processing the transaction.

IC Markets offers two types of MetaTrader accounts: Standard and Raw Spread. IC Markets does not charge commission on Standard accounts, but instead applies a spread margin of 1 pip above interbank prices received from liquidity providers.

The IC Markets Raw Spread account displays the interbank spread received from liquidity providers . This account charges a commission of $7 per standard round-trip lot. For euros, the commission is $5.50, for British pounds, $5.00, and for Swiss francs, $6.60.

IC Markets Reviews

On Trust Pilot, broker IC Markets received a very high rating of 4.9 (out of 5) based on approximately 26,000 reviews. Users primarily note its low spreads, fast order execution, and excellent customer service.

In mobile app stores, IC Markets cTrader for Android is rated 4.3 by approximately 5,000 users (the app has been downloaded over 100,000 times). The same app, but on iOS, received an average rating of 4.4 based on 85 reviews.

FAQ

Czy IC Markest jest bezpieczne?

Tak, jest to jeden z największych brokerów na świecie, który działa nieprzerwanie od 2007 roku oraz posiada licencje ASIC, CySEC i FSA.

Jaki jest minimalny depozyt w IC Markets?

Minimalny depozyt wynosi 200 dolarów, niezależnie od rachunku handlowego, który założysz.

Czy IC Markets świadczy wsparcie po polsku?

Niestety nie, broker oferuje support w języku angielskim. Jest jednak dostępny 24 godziny na dobę, przez 7 dni w tygodniu.

W co można inwestować na IC Markets?

Broker oferuje handel instrumentami CFD na waluty (forex), akcje, surowce, indeksy, kryptowaluty, metale i inne.

Czy konto w IC Markets jest płatne?

Nie, broker nie pobiera żadnych opłat od wpłat, wypłat oraz od transakcji, naliczając jedynie standardowe spready. W przypadku rachunków Raw Spread opłaty jednak są naliczane. Szczegóły dostępne są na stronie brokera.

Czy IC Markets to broker ECN/STP, czy Market Maker?

IC Markets jest emitentem produktów, które dostarcza. Sam opisuje siebie jako dostawcę usług forex w modelu cenowym ECN, ponieważ ceny pochodzą od zewnętrznych, niepowiązanych dostawców płynności i są przekazywane klientowi bez interwencji dealera.

Czy IC Markets oferuje rachunek demonstracyjny?

Każdy inwestor może w IC Markets założyć rachunek demo, testując każdy z trzech rodzajów kont, różne poziomy dźwigni finansowej oraz różne klasy aktywów. Założenie zajmuje tylko kilka minut i wymaga podania jedynie podstawowych danych.

Jaka jest różnica między rachunkami IC Markets Standard oraz Raw?

IC Markets posiada dwa rodzaje kont MetaTrader: Rachunek Standardowy oraz Rachunek Raw Spread. IC Markets nie pobiera prowizji od standardowych rachunków, zamiast tego nalicza spread. Rachunek Raw Spread pokazuje natomiast spread międzybankowy otrzymany od naszych dostawców płynności. Na tym rachunku pobierana jest prowizja w wysokości 3,5 dol. za każdy standardowy lot zarówno przy transakcji kupna i sprzedaży.

Czy w IC Markets mogę posiadać wiele różnych rachunków?

IC Markets pozwala na otwarcie wielu rachunków handlowych. Możesz otworzyć dodatkowe konto tradingowe poprzez swoją Strefę Klienta.

Jakie pary walutowe Forex znajdują się w ofercie IC Markets?

IC Markets oferuje ponad 75 par walutowych, w tym kryptowaluty. Inwestorzy mogą otwierać pozycje na najpopularniejszych parach walutowych z dolarem amerykańskim oraz na szeregu par krzyżowych.