Plus500 is an Israeli-based retail broker offering contracts for difference ( CFD ) trading. Its portfolio includes over 2,800 instruments, used by 23 million customers in 50 countries worldwide.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

The broker has various branches that are regulated by different supervisory institutions:

Plus500 UK LTD is regulated by the Financial Conduct Authority (FRN 509909).

Plus500 CY LTD is regulated by the Cyprus Securities and Exchange Commission (License No. 250/14).

Plus500 AU LTD is regulated by the Australian Securities and Investments Commission – Australia only (AFSL #417727).

Contents:

CFD Offer at Plus500

For years, the core of Plus500’s offering has been contracts for difference , offered on the foreign exchange market, indices, commodities, shares, options, ETFs and cryptocurrencies.

Most of Plus500’s services are free, but in some cases, commissions may apply. You can read about Plus500 CFD fees here: https://www.plus500.com/en-CY/help/feescharges?productType=CFD ; and you can find information about Plus500 Invest fees here: https://www.plus500.com/en-CY/Invest/Help/FeesCharges

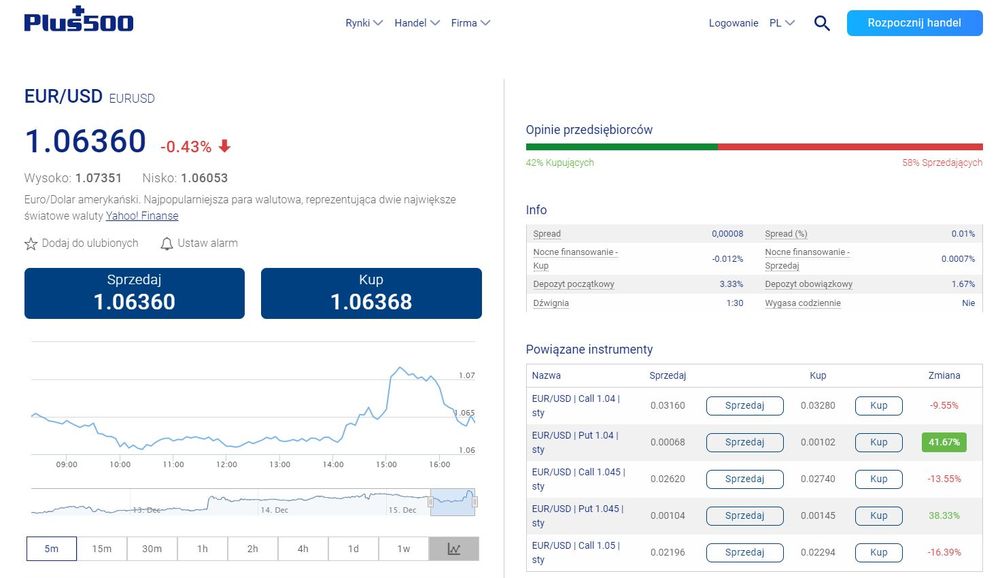

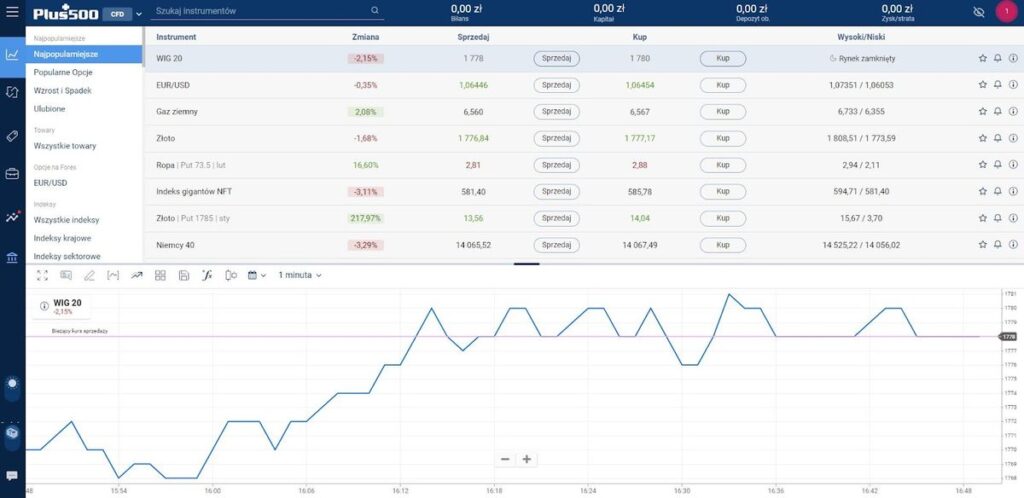

Each CFD instrument has its own detailed information page ( here ) , where you can find a chart, the current price, information about the spread and related instruments, a macroeconomic calendar, as well as the sentiment of Plus500 customers regarding a specific asset (this pattern applies to all asset classes).

Forex

The Plus500 broker offers access to over 60 currency pairs on the Forex market with leverage up to 30:1. The minimum amount to start trading is PLN 500. In addition to investing in basic pairs, they also offer pairs with the Polish złoty.

Plus500 doesn’t charge commission for currency trading; instead, it generates its profits through the spread , which is the difference between the buy and sell price of a given currency pair. Other costs that may be incurred include swap, currency conversion fees, and a $10 monthly inactivity fee if a trader doesn’t log in to their account for a quarter.

Goods

Plus500 offers over 20 instruments in the commodities and raw materials markets , including popular assets like gold, silver, and platinum, as well as less popular options like feeder cattle, live cattle, and pig carcasses.

Cryptocurrencies

Cryptocurrency futures are available at Plus500 24/7 (except for one hour on Sundays). However, it’s important to remember that these are CFDs , so opening a position doesn’t mean you’re buying the underlying asset or rights to it. However, you can leverage your trading and trade not only on the rising but also the falling prices of cryptocurrency instruments.

Plus500 offers the most popular digital assets. Besides Bitcoin (BTC), Ether (ETH), and the ETH/BTC pair, there are 20 of them in total . In addition to cryptocurrency pairs, investors can also trade an index of the 10 most popular cryptocurrencies, as well as an index of companies from the NFT or metaverse industries.

Shares

An investor looking to trade shares at Plus500 has a wide range of stock CFDs to choose from.

It is worth noting that in the case of CFDs, a large number of shares will be available (including those listed on the WSE) .

Indices, Options and ETFs

The broker’s CFD offering also includes stock index contracts, options, and ETFs . In addition to core national indices for the largest stock exchanges, the offering also includes proprietary sector indices, including FANG companies, real estate giants, and the largest companies in the metaverse and NFT industries.

CFDs on options, on the other hand, are a mix of instruments based on put and call options on the most popular instruments: commodities and Wall Street stocks. Offers include oil, Apple, Tesla, gold, DAX, and Bitcoin.

The list of ETFs includes several dozen of the most popular instruments listed on global stock exchanges, such as iShares Silver, TQQQ or ARKK.

Real shares at Plus500 Invest

In June 2021, the broker also added investing in real shares to its offer.

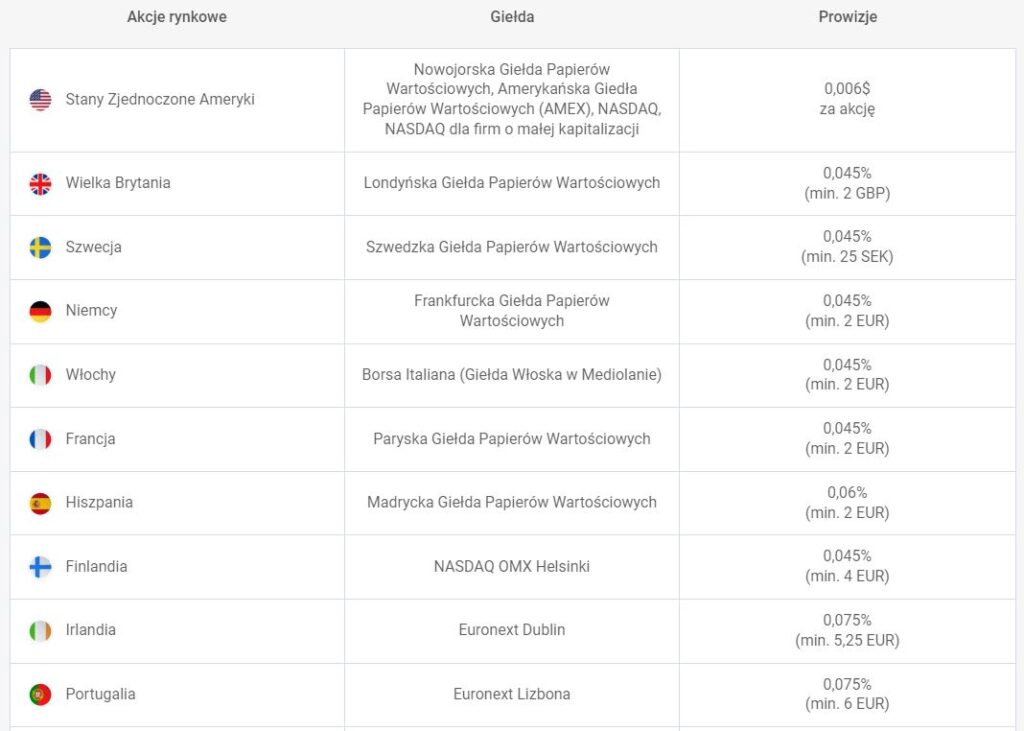

Invest offers access to markets including Germany, Italy, France, Spain, Finland, Ireland, Portugal, Denmark, Austria, Norway, Australia and the Netherlands.

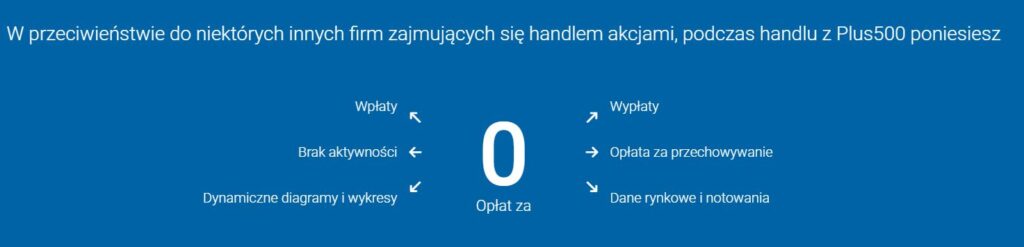

The Invest platform offers no fees for withdrawals and deposits, low trading commissions, no fees for storing funds and no fees for using the platform. Trading commissions on real shares will vary depending on the market. For example , for US stock exchanges, they are $0.006 per share purchased , while on other markets, they are a percentage of the transaction. For London shares, they are 0.045% (minimum £2).

A full list of fees for Plus500 Invest is available here .

Below are the details about the commission:

Plus500 Fees and Commissions

As mentioned earlier, Plus 500 charges virtually no additional fees for CFDs.

A full list of fees and commissions for contracts for difference is available here .

Deposits and withdrawals are free of charge , and investors can use traditional bank transfers, Visa and Mastercard payment cards and payment services such as PayPal, Skrill, Klarna, GiroPay, Trustly, Przelewy24 and payments via BLIK.

However, the customer may pay in the event of currency conversion to the currency of the base account and for account inactivity.

Plus500 platform

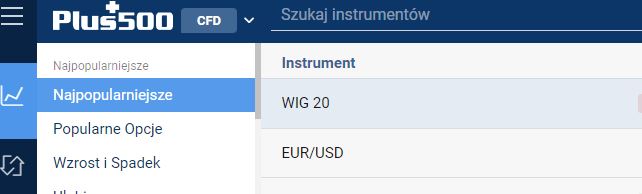

Plus500, unlike many other CFD brokers, has never used MetaQuotes platforms (i.e., the popular MetaTrader 4 or 5), instead offering its own proprietary trading platform . Currently, this platform is available in a browser and as a mobile app for iOS and Android devices .

In each of these versions, the platforms are very similar and feature an intuitive design. The charting tool allows you to create basic technical analysis drawings, add the most popular indicators and oscillators, and switch between chart types and time intervals.

In 2022, Plus500 also introduced +Insights, a service intended as a gateway to social investing (social trading). Using this simple tool , you can track trends within the Plus500 customer community and learn which instruments are most frequently traded, which positions generate the biggest profits/losses, which assets are most frequently bought/sold, and where the highest returns are currently generated. With +Insights, you can apply your own filters and directly buy or sell an instrument.

Demo Account at Plus 500

Plus500, like many other brokers, offers a demo mode where you can familiarize yourself with how the platform works and trade CFDs using 200,000 virtual zlotys .

Setting up a demo account is incredibly easy. Simply go to the Plus500 home page ( here ) and click the “Start Trading” button in the top right corner.

Then simply select “demo mode” and enter your email address and password to go straight to the platform.

In the platform view, you can switch between demo and real accounts using the button in the lower left corner.

Reviews of Plus500

On TrustPilot , the Plus500 broker has a rating of 4.1 out of 5, based on over 11,000 votes . In the Google Play Store, where the trading app has been downloaded over 10 million times, it is rated 4.3 out of 5 (over 102,000 reviews) . In the Apple App Store , the app has received 306 ratings from Polish users, with an average rating of 4.2 out of 5 .

FAQ

Czy handel w Plus500 jest bezpłatny?

Plus500 nie pobiera opłat za otwarcie i prowadzenie rachunku oraz wpłaty i wypłaty. Oprócz tego na pozycjach CFD naliczane są tradycyjne spready. Możesz przeczytać na temat opłat w Plus500 CFD tutaj: https://www.plus500.com/pl-cy/help/feescharges?productType=CFD; z kolei tutaj znajdziesz informacje na temat opłat z Plus500 Invest: https://www.plus500.com/en-CY/Invest/Help/FeesCharges

Czy w Plus500 jest bezpieczne?

Platforma Plus500 posiada regulacje w różnych krajach i jest jednym z najdłużej działających brokerów na rynku.

Jak dokonać wpłaty środków na Plus500?

Przejdź do platformy handlowej i znajdź na niej opcję wpłaty. Wybierz jedną z preferowanych metod płatności (przelew bankowy, karta płatnicza, BLIK lub bramki płatnicze). Na urządzeniach mobilnych przejdź natomiast do zakładki „Fundusze”.

Czy w Plus500 można handlować na koncie demo?

Tak, Plus500 posiada w swojej ofercie rachunek demonstracyjny, który zakłada się w kilkadziesiąt sekund. Wystarczy podać e-mail i utworzyć hasło, aby móc handlować wirtualnymi środkami w wysokości 200 tys. zł. Z demo można skorzystać również jako posiadacz konta realnego. Przełącza się między nimi z poziomu platformy.

Czy Plus500 oferuje handel akcjami?

W Plus500 dostępne są realne akcje dzięki ofercie Invest. Do handlu akcjami realnymi stworzona została osobna platforma o nazwie właśnie Plus500 Invest.

Handel kryptowalutami w Plus500 jest możliwy?

Plus500 oferuje instrumenty kryptowalutowe w formie CFD, dostępne przez 24 godziny na dobę, 7 dni w tygodniu. CFD to jedynie kontrakt, a nie instrument bazowy, klient nie nabywa więc kryptowaluty ani związanych z nią praw. Może jednak korzystać z dźwigni finansowej i grać na spadki oraz wzrosty danego instrumentu.

Jakich dokumentów wymaga Plus500 do weryfikacji?

Zakładając nowe konto klient musi zweryfikować swoją tożsamość oraz adres zamieszkania. W tym celu niezbędny będzie dokument tożsamości oraz wyciąg z konta bankowego, karty lub rachunek za media w celu potwierdzenia adresu.

Czy Plus500 jest brokerem regulowanym?

Tak, Plus500 jest regulowany i to w wielu jurysdykcjach. Posiada licencje poważanych instytucji nadzoru, w tym CySEC, ASIC oraz FCA. Klienci z Europy współpracują ze spółką cypryjską, licencjonowaną przez wspomniany CySEC.

Czy Plus500 pozwala handlować na indeksach?

Z brokerem Plus500 można handlować na najpopularniejszych indeksach giełdowych z całego świata, a także na indeksach sektorowych zrzeszających w jeden instrument popularne spółki z danych branż: technologicznej, konopnej, czy na przykład kryptowalutowej. Handel indeksami odbywa się na platformie Plus500 CFD i są dostępne jedynie w formie instrumentów CFD.

Jak długo Plus500 wypłaca środki?

Czas przetwarzania zlecenia wypłaty wynosi w większości wypadków jeden dzień roboczy. Czas otrzymania środków będzie zależał od wybranej metody płatności oraz czasu jej przetwarzania przez stronę trzecią.