XTB is a Polish Forex broker established in 2004 and providing brokerage services since 2005. It has won numerous awards, including one of the best brokers in its class in Eastern Europe.

Regulated not only by the Polish Financial Supervision Authority (KNF), but also by the UK Financial Conduct Authority (FCA), Cyprus’s CySEC, and the Dubai Financial Services Authority (DFSA). The broker offers its proprietary trading platform, xStation. Various accounts are available with spreads starting from 0 pips.

It’s worth noting that XTB is one of the largest brokers in Europe, serving an average of over 100,000 active traders per month (2021 data). However, the broker also operates in Latin America and the Middle East. XTB is also listed on the Warsaw Stock Exchange (WSE).

Contents:

- XTB Quotes – Shares

- XTB offer

- Account types, costs, commissions, fees

- Demo account

- Investment platforms: xStation 5 and xStation Mobile

- Market news and education

- FAQ

- Summary

XTB Quotes – Shares

Check the current share price of the XTB broker on the chart below.

XTB offer

The broker offers a very broad offering that goes far beyond the forex market. In total, XTB offers over 7,500 different instruments, ranging from stocks to cryptocurrency contracts.

A list of all current instruments is available here

.

Deposit interest rates

XTB offers its clients a unique feature on a global scale. All client funds deposited in investment accounts not involved in transactions are subject to interest. This means you can earn between 2.25% and 6.1% per annum, compounded monthly, on deposited funds (as of March 31, 2025).

Shares

At XTB, you can buy physical shares just like at a traditional brokerage house. Moreover, you have access to shares of over 3,700 companies from 16 trading floors worldwide , from countries such as Belgium, the Czech Republic, Denmark, Finland, France, Spain, the Netherlands, Germany, Norway, Poland, Portugal, the United States, Switzerland, Sweden, the United Kingdom, and Italy.

These are the major exchanges in the above-mentioned countries, including the NYSE, WSE, LSE, and Euronext. What companies can we buy on these exchanges? These tend to be slightly more liquid, so we don’t have access to the entire offerings of the aforementioned exchanges. Nevertheless, among the over 2,000 entities, you’re sure to find interesting assets, such as Apple, CD Projekt, Amazon, or BMW.

It’s worth noting that XTB doesn’t charge commissions on stock trading , but with one caveat. Commissions are waived for monthly turnovers of up to EUR 100,000. Transactions above this limit will be charged a 0.2% commission (min. EUR 10).

It is worth adding that XTB also allows you to submit the W8-BEN form , which allows you to reduce the tax on dividends from American companies from 30 to 15%.

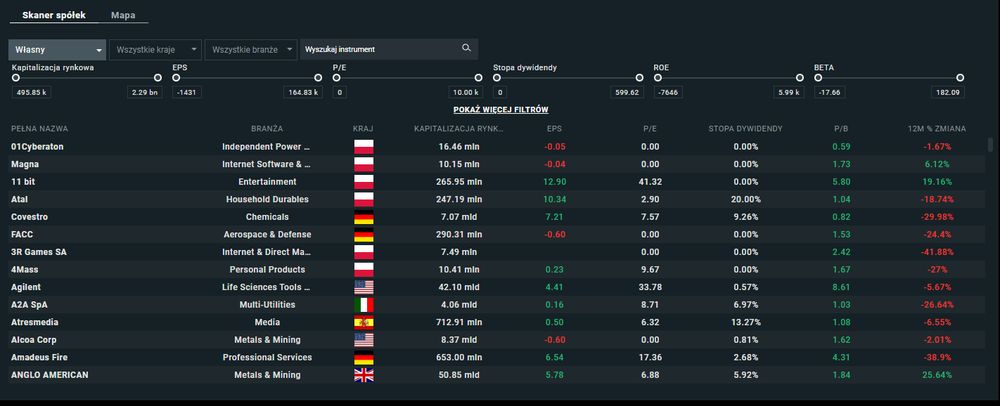

In the case of the stock market, XTB offers a market analysis tool as part of its investment platform: a company scanner and a map of the most popular companies.

CFD

CFD products are a specific type of instrument whose full name is Contract for Difference. This means that when you buy a CFD, you’re not actually buying a specific asset, but placing a bet on its price change. Learn more about these types of contracts.

you will find out here

.

What’s important with this type of instrument is

trading leverage

. It allows for much larger transactions using significantly less capital. It’s worth noting that this is a double-edged sword, allowing for maximizing profits with small asset movements, but also for the rapid loss of deposited capital. XTB (like other European brokers) offers negative balance protection. This means that as a result of a failed transaction, you can’t lose more than your deposited amount.

Forex

XTB operates under a Market Maker model, meaning the broker itself drives the market we trade and is therefore the counterparty to the transaction. It offers

The xStation platform divides forex currency pairs into majors, minors, and emerging market currencies. Pairs with the Polish zloty are also available.

Indexes

Stock market indices are baskets of shares created by individual stock exchanges, most often consisting of the largest companies from the entire stock exchange (e.g., WIG20) or a given sector. In this way, indices provide exposure to the entire market in a given country, reducing the risk of underperformance by a specific company.

XTB offers the option to purchase these types of indices via CFDs. We have over 25 indices available from countries such as the US, Germany, and China.

Raw Materials and Goods

Commodities are another CFD asset, providing exposure to commodities such as gold, silver, oil, and corn. At XTB, you can trade over 25 such instruments. They are divided into the following categories: agriculture, energy, industrial metals, precious metals, livestock, and others.

Cryptocurrencies at XTB

Another category of CFD instruments are cryptocurrencies. XTB offers access to dozens of popular cryptocurrencies, including Bitcoin, Ethereum, BNB, and Dogecoin. Spreads on cryptocurrencies range from 0.22% to 3% depending on the liquidity of the asset.

XTB offers a maximum leverage of 2:1 and low transaction costs in the cryptocurrency market.

ETFs at XTB

An ETF (exchange-traded fund) is an exchange-traded fund listed on a stock exchange. They typically have lower management costs (fees). They allow for investments in specific markets, industries, or economic sectors, providing exposure to, for example, gold mining companies or the largest dividend-paying companies.

XTB offers over 1,320 ETFs from around the world. As with stocks, the broker charges no commission on transactions up to a monthly turnover of €100,000. The minimum transaction value is 10 PLN.

If the transaction limit of EUR 100,000 is exceeded, the broker starts charging a commission of 0.2% (with a minimum value of PLN 10).

XTB – account types, costs, commissions, fees

Maintaining an account with XTB is free, with most fees charged upon execution of a transaction. The broker currently offers one account type called STANDARD.

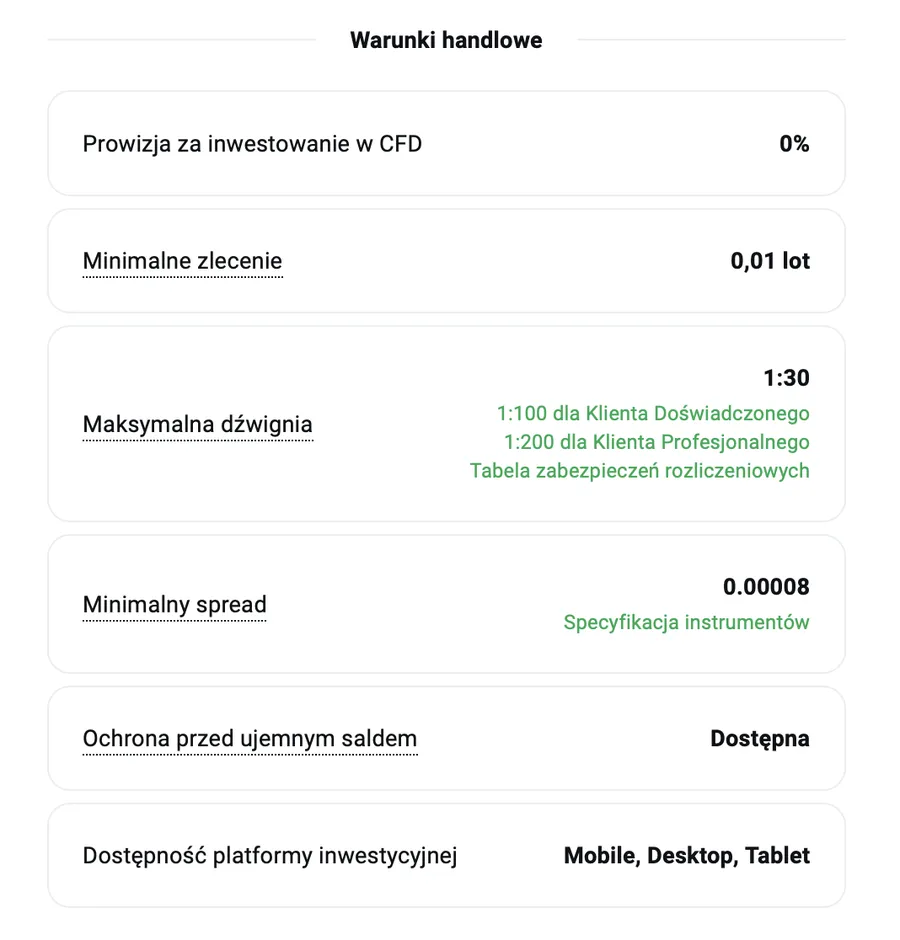

Deposit fees are 0 PLN , and can be made via standard bank transfers using popular payment gateways. Fees are charged for card deposits. The minimum spread is 0.00008 PLN (for cryptocurrencies, it ranges from 0.22% to 0.35% of the market price), and the minimum order size is 0.01 lot (1 lot for stocks and ETFs).

Withdrawals are also free.

Investors can use a variety of methods to make deposits or withdrawals. These include bank transfers, credit cards, and e-payments using PayPal, BlueCash, PayU, and Blik. Deposits and withdrawals are processed via the investor’s room. Withdrawals are processed by 2:30 PM. This means that instructions submitted after this time will not be processed until the next business day. Funds are transferred within one business day from the moment the instruction is submitted.

For CFD products,

spreads

are applied at the time of transaction, similar to traditional currency exchanges. Additional fees in the form of swaps may also be charged when holding CFD positions overnight.

However, when trading stocks and ETFs, the broker charges no commission up to a monthly turnover of €100,000. Above this amount, the commission is 0.2% (min. €10).

Here you will find all the details about your trading account.

IKE at XTB

The broker also offers an Individual Retirement Account (IKE), where you can invest tax-free and save for retirement. Trading conditions for this account are the same as for the standard account, meaning you don’t pay commission on trading up to €100,000 in monthly turnover.

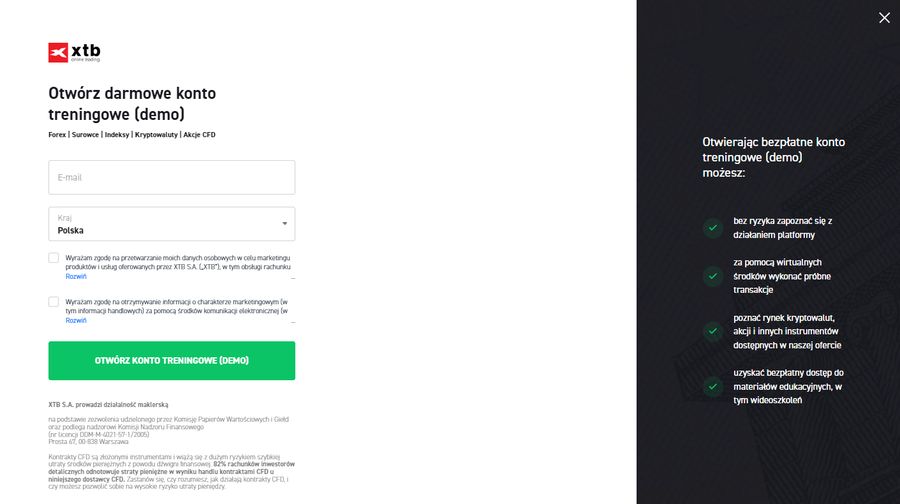

XTB Demo Account

In addition to the real account, XTB also offers a demo account, which allows you to familiarize yourself with the principles of operation of the platform and conduct transactions with virtual funds.

In the demo version, access to the trading platform is not limited in any way, but after a certain time the account is blocked in order to open a full real account.

You can open a demo account from the XTB homepage or by simply clicking here . You’ll be asked to provide your email address and country of origin, as well as confirm your marketing consent.

In the second step, you’ll need to provide your name, phone number, and password. Your account is created in seconds, and you can immediately log in to the XTB Demo trading platform.

Investment Plans

Investment Plans is a solution provided by XTB for those who want to automate their ETF investments. How does it work?

- Choosing ETFs

Build your portfolio based on over 350 ETFs, differing in components, rate of return or rating. - Allocate funds

You don’t need to calculate anything – simply determine what percentage of your Plan amount should be invested in each ETF. - Deposit funds

You can get started with Investment Plans from as little as PLN 50, using a range of deposit methods, including free and instant. Set up recurring payments to regularly fund your Plan. - Watch your investments perform

Investment platforms: xStation 5 and xStation Mobile

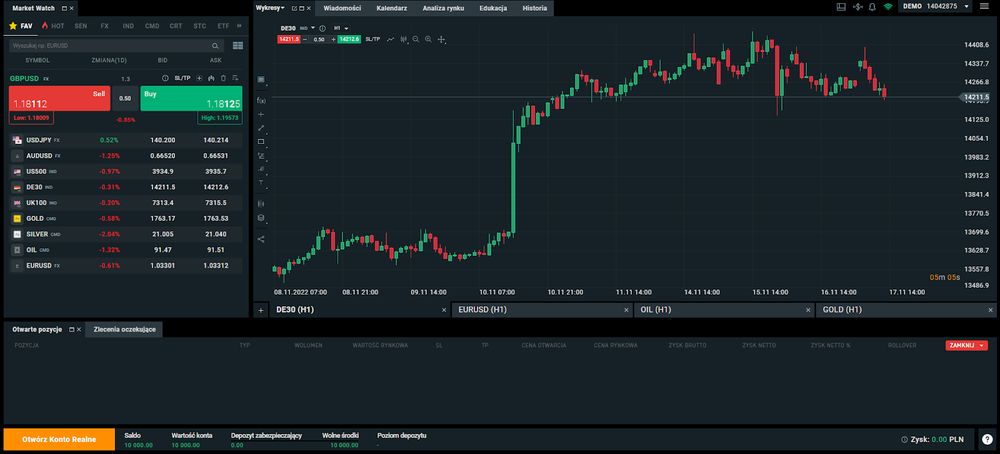

Broker XTB currently offers its users only its proprietary xStation platform . The desktop version is a browser-based web or desktop application called xStation 5 , while the xStation Mobile app is available for mobile phones and tablets.

Both in mobile and desktop versions, xStation provides dozens of technical analysis and drawing tools that allow for in-depth chart analysis. The platform also includes a news feed with the latest news, a macroeconomic calendar, and an education section.

Market news and education

XTB places great emphasis on educating individual investors by organizing its own conferences with market experts, running daily webinars, and an open portal with information and analyses prepared by the brokerage house’s team of economists.

The Education section located directly on the xStation platform includes recordings on basic indicators and trading rules, as well as archived recordings from educational webinars and conferences organized by XTB.

At

https://www.xtb.com/pl/analizy-rynkowe/wiadomosci-rynkowe

you can find current market information with open access as well as market analyses and insights with closed access, reserved only for real account holders.

FAQ

Below you will find answers to the most frequently asked questions about the XTB broker.

Czy XTB jest bezpieczne?

Tak, broker XTB jest jednym z największych w Polsce oraz posiada niezbędne licencje, m.in. KNF.

Czy XTB świadczy wsparcie w języku polskim?

Tak, XTB to polski broker oraz posiada pełne wsparcie dla polskich klientów.

Jaki jest minimalny depozyt na XTB?

XTB nie wyznacza minimalnego depozytu, który musisz wpłacić by zacząć handel.

W co można inwestować na XTB?

XTB oferuje dostęp do produktów CFD na waluty (forex), indeksy, akcje, surowce i kryptowaluty. Dodatkowo oferuje również handel zwykłymi akcjami oraz funduszami ETF.

Czy konto w XTB jest płatne?

Nie, broker pobiera jedynie prowizje od zawieranych transakcji.

Jak mogę zasilić moje konto w XTB?

Konto zasilane jest przez panel klienta w aplikacji xStation poprzez przelew bankowy, karty płatnicze lub portfele elektroniczne typu Paysfae oraz transakcje BLIK.

Jak mogę wypłacić środki z XTB?

Poprzez panel klienta na platformie xStation, zlecenia przyjmowane są do godziny 14:30 i realizowane zazwyczaj w przeciągu dnia roboczego od przyjęcia informacji o chęci wypłaty.

Ile czasu potrzebuję, aby założyć rachunek handlowy w XTB?

Proces zakładania rachunku handlowego trwa do 15 minut. Po przesłaniu do brokera wszystkich dokumentów i potwierdzeniu tożsamości, rachunek jest rejestrowany zazwyczaj od ręki, zazwyczaj w czasie nie dłuższym niż jeden dzień.

Jak zostać partnerem lub IB w XTB?

XTB prowadzi współpracę z afiliantami oraz brokerami wprowadzającymi (IB). Informacje na ten temat dostępne są bezpośrednio na stronie brokera.

Czy XTB to dobry broker dla początkujących?

XTB jest odpowiednim wyborem dla początkujących inwestorów za sprawą na intuicyjną platformę xStation 5, szeroki wybór instrumentów oraz rozbudowany dział edukacji.

Summary

XTB is a broker with over 20 years of experience , one of the few in the world to be publicly listed on the stock exchange, and transactions using its xStation platform are subject to a low level of risk (in terms of the stability of the company itself).

In terms of offerings and trading conditions, XTB deserves high marks due to its wide selection of instruments and zero or low fees. It is a recommended choice for beginners and experienced investors due to its extensive educational base and constant access to fresh materials.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this CFD provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.