It’s hard to find a paid forex trading course that, instead of indicators, trends, and levels, offers you an understanding of the economic situation of the country whose currency you intend to buy. It’s no wonder – fundamental analysis isn’t easy to sell. It’s time-consuming, complex, and doesn’t guarantee anything. If you’re a beginner, however, there are two simple tools that, while they won’t help you make money, will protect you from getting stuck in a trade that was doomed from the start. These are currency indices and the Treasury bond yield spread.

Why do you need currency indices for Forex?

If you’re watching the EUR/USD currency pair fluctuate, you can’t put it into context . To find out if it’s in line with the general direction of the currency in other markets, you’ll need to open charts of the EUR/JPY, EUR/GBP, or EUR/CHF pairs and then analyze each one individually.

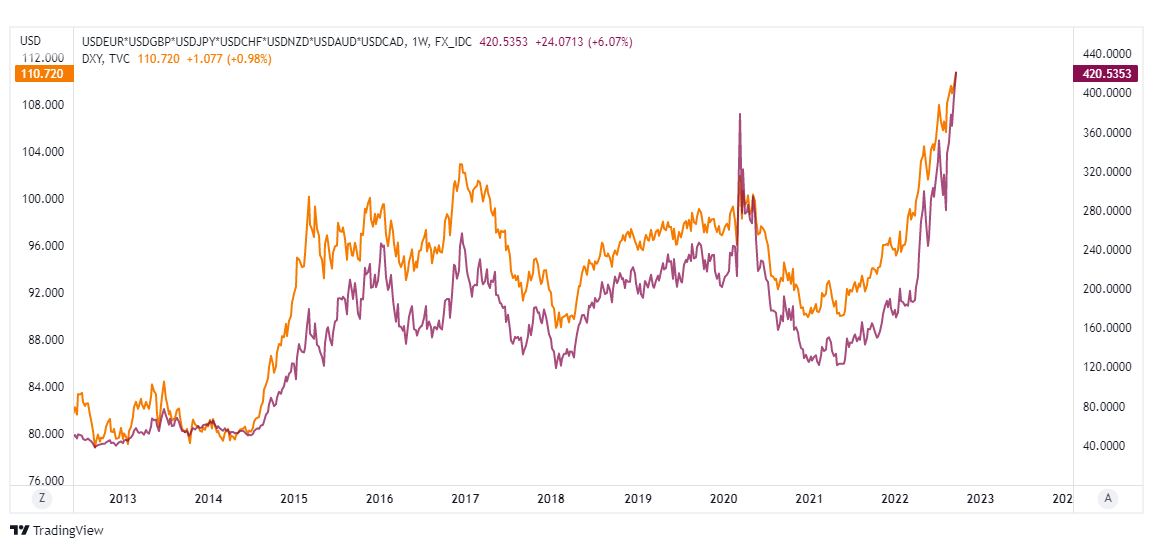

DXY (orange) vs dollar index from the table.

Moreover, in the frequently used dollar index – DXY, the weight of currencies is not distributed evenly – almost 60% of this index is accounted for by the euro (you can see the weight of individual currencies in DXY in the table below).

|

euro |

57.6% |

| yen | 13.6% |

| pound | 11.9% |

| Canadian dollar | 9.1% |

| Swedish krona | 4.2% |

| Swiss franc |

3.6% |

An equally weighted currency index, as a comparison of the base currency with a whole basket of other currencies, eliminates both of these problems.

The table below contains formulas for the eight major currency indices that you can use on the Tradingview platform . Simply copy one of them into the “Symbol Search” bar and click “Enter.”

| Euro index | EURUSD*EURGBP*EURJPY*EURCHF*EURCAD*EURAUD*EURNZD |

| Dollar Index | USDEUR*USDGBP*USDJPY*USDCHF*USDNZD*USDAUD*USDCAD |

| Pound Index | GBPUSD*GBPEUR*GBPJPY*GBPCHF*GBPCAD*GBPNZD*GBPAUD |

| Yen index | JPYEUR*JPYUSD*JPYGBP*JPYCHF*JPYCAD*JPYAUD*JPYNZD |

| Franc index | CHFUSD*CHFEUR*CHFJPY*CHFGBP*CHFCAD*CHFAUD*CHFNZD |

| Canadian Dollar Index | CADUSD*CADEUR*CADJPY*CADGBP*CADCHF*CADAUD*CADNZD |

| Australian Dollar Index | AUDUSD*AUDEUR*AUDJPY*AUDGBP*AUDCHF*AUDCAD*AUDNZD |

| New Zealand Dollar Index | NZDUSD*NZDEUR*NZDJPY*NZDGBP*NZDCHF*NZDCAD*NZDAUD |

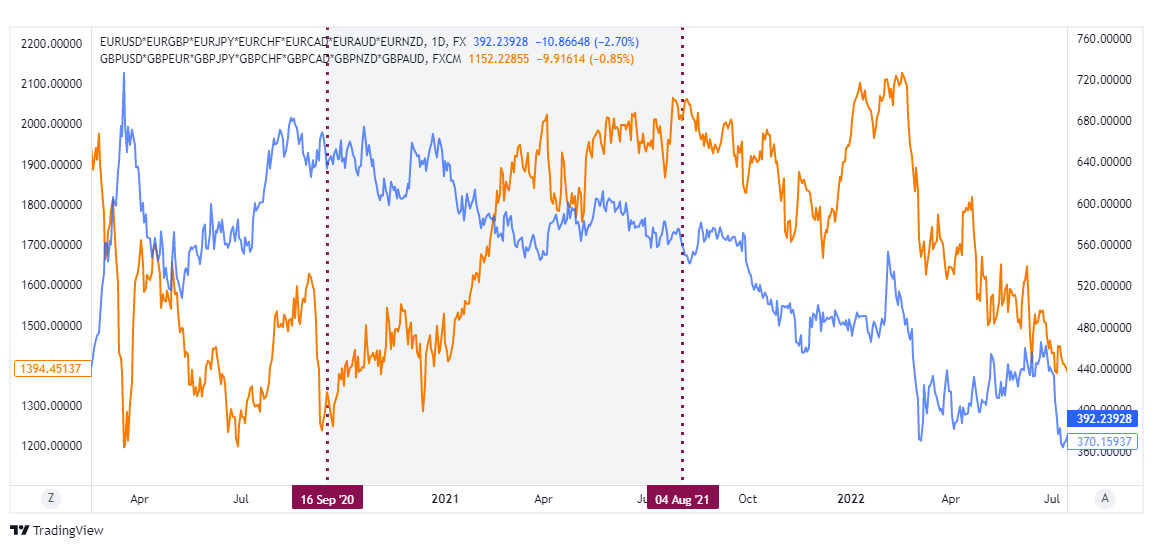

The image shows graphs of the two indices from the table, showing a situation where the euro and the British pound were moving in opposite directions . While the euro (blue) was consistently weakening against major currencies, the pound index (orange) was rising sharply.

The marked “window” lasts from around September 16, 2020, to August 4, 2021 .

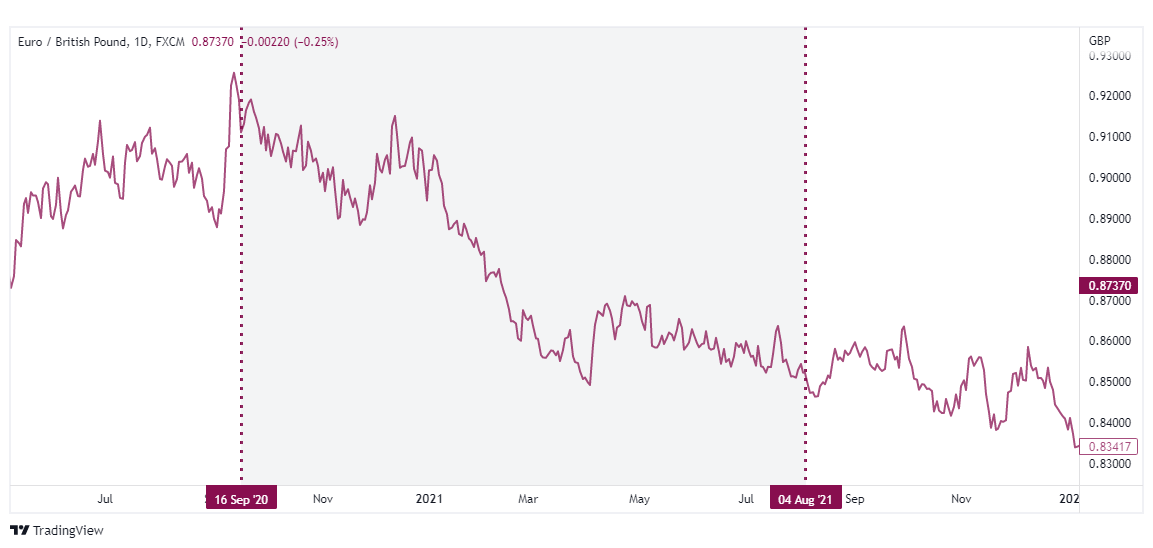

The EUR/GBP chart for the same period looked like this:

Simplifying Forex Fundamental Analysis with Indices

If you don’t follow economic news closely, all you have to do is compare two currencies and you’ll see a divergence forming .

Then you will be able to take a closer look at the situation, familiarizing yourself with the fundamental context, for example by reading reports prepared by banks ( reports of this type are regularly published by e.g. Citi Bank or Wells Fargo ).

This way, as a trader just starting out with “fundamentals,” you can reverse the analysis process . Traditionally, it begins with Bloomberg, Reuters, or the aforementioned reports. However, wading through the vast amount of content can be quite tedious if you don’t fully understand what you’re looking for.

When using indices, you first look at charts and only when you see something interesting do you try to gather current information about the selected economies.

Forex – USD/JPY: example

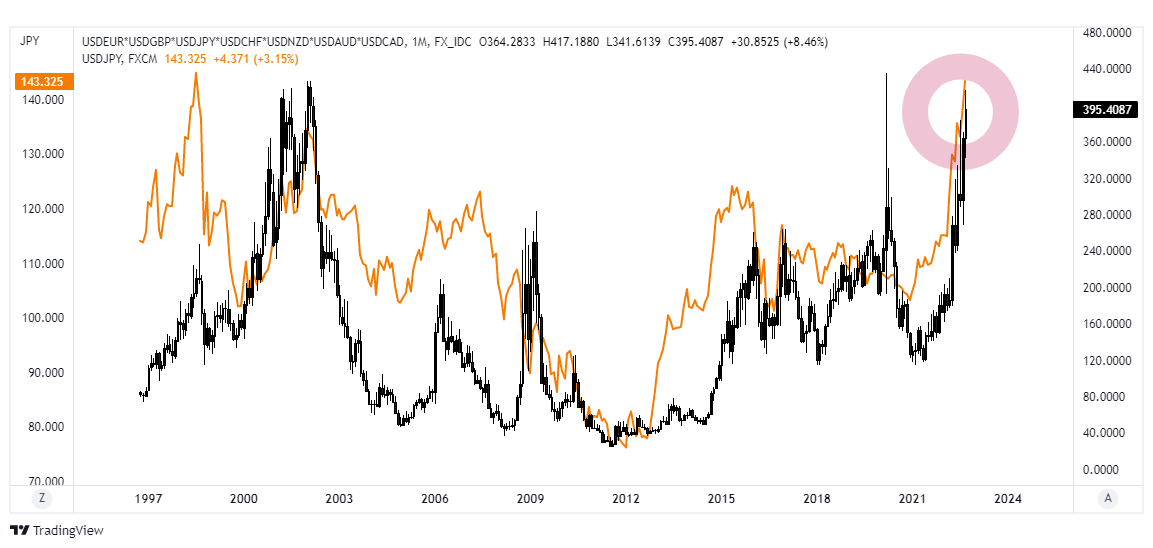

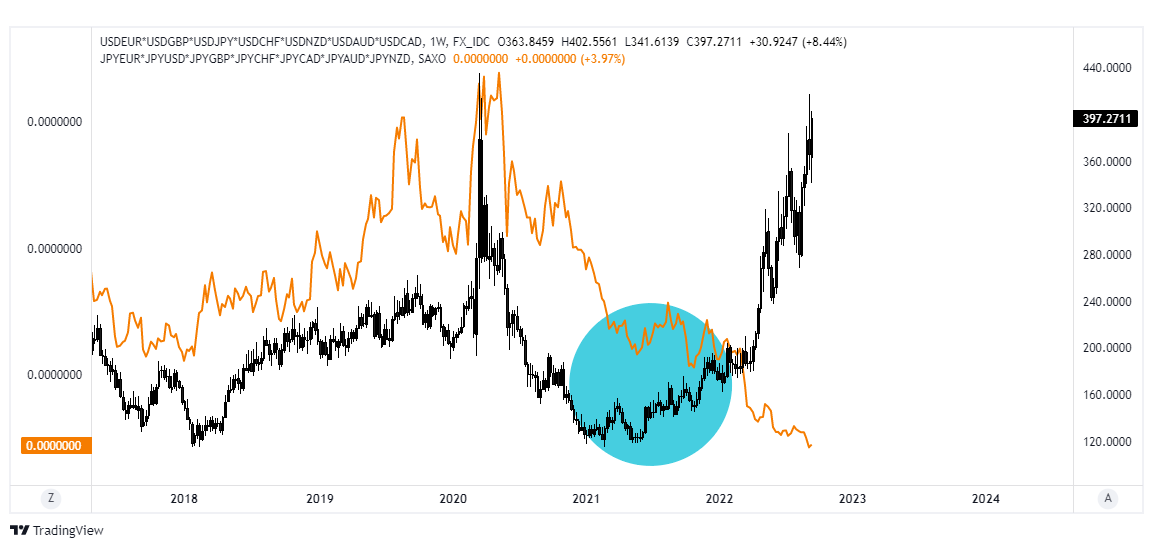

Notice the recent, massive strengthening of the dollar against the yen (black – dollar index, orange – yen index).

Yen and US dollar index charts.

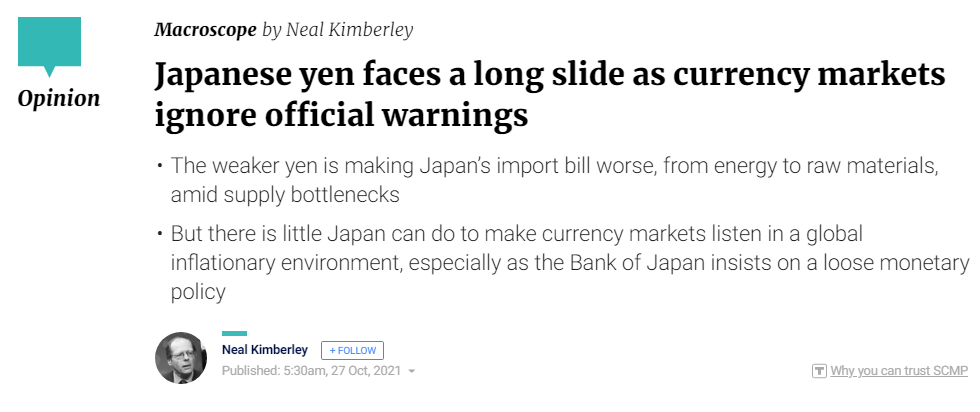

If you Google the phrase “japanese yen” and filter the dates to the end of 2021, you’ll find articles like the one below.

Source: https://www.scmp.com/comment/opinion/asia/article/3153590/japanese-yen-faces-long-slide-currency-markets-ignore-official

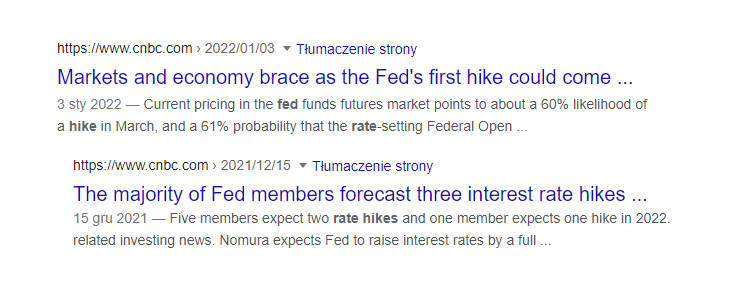

At the end of 2021, the Japanese central bank, despite the weakening yen, clung to its loose monetary policy. This occurred at a time when financial markets in the United States began to anticipate the first interest rate hike due to record inflation.

The divergence of the directions in which two economic systems are moving is, in turn, the essence of Forex trading, and if, having all this information, you would not decide to go long on USD/JPY, you would at least know that opening a short position here is excluded.

Forex Trading – Playing Against Currency Indices Trends

Alternatively, you can use the index to identify trends and look for arguments to trade against them. This can be useful in the event of extreme appreciation of one currency against another.

Take a look at the dollar index comparison from our chart against the USD/JPY pair. At the time of writing, the charts, which show the historical fluctuation since 1997, are at high levels.

In such a situation, although it is apparently much riskier, we can look for signals of tightening monetary policy in Japan and a suspension of the interest rate hike cycle by the FED in order to play a “short” on the USD/JPY pair.

Trading Forex and Bond Yield, i.e. the current yield on treasury bonds

Another important tool is the yield on government bonds.

Bonds are securities that represent debt and serve as a way for states (treasury bonds) or corporations (corporate bonds) to raise funds . The issuer, in our case the state, issues treasury bonds, which are then purchased by investors. These investors automatically become creditors, known as bondholders.

For example, we have a debt in the form of a 5-year Treasury bond worth $1,000 with a 0.5% coupon, with interest paid to bondholders annually. This means that:

- The bonds will be redeemed (and thus the debt will be repaid) by the issuer five years after issue . In English, the redemption date is known as “maturity.”

- The bondholder, or the entity holding the debt, will receive interest each year at 0.5% of the bond’s value (in this case, 0.5% of $1,000). Therefore, after five years, the investor will receive back $1,025 (the loan amount plus interest).

Although the bond’s value and coupon are fixed, there is also a current yield (Yield), which varies . This yield inversely correlates with the bond’s price; that is, when prices rise, Yield falls . When prices fall, Yield rises. It’s a simple law of supply and demand: if a given bond isn’t in demand, the interest rate it offers rises, attracting buyers .

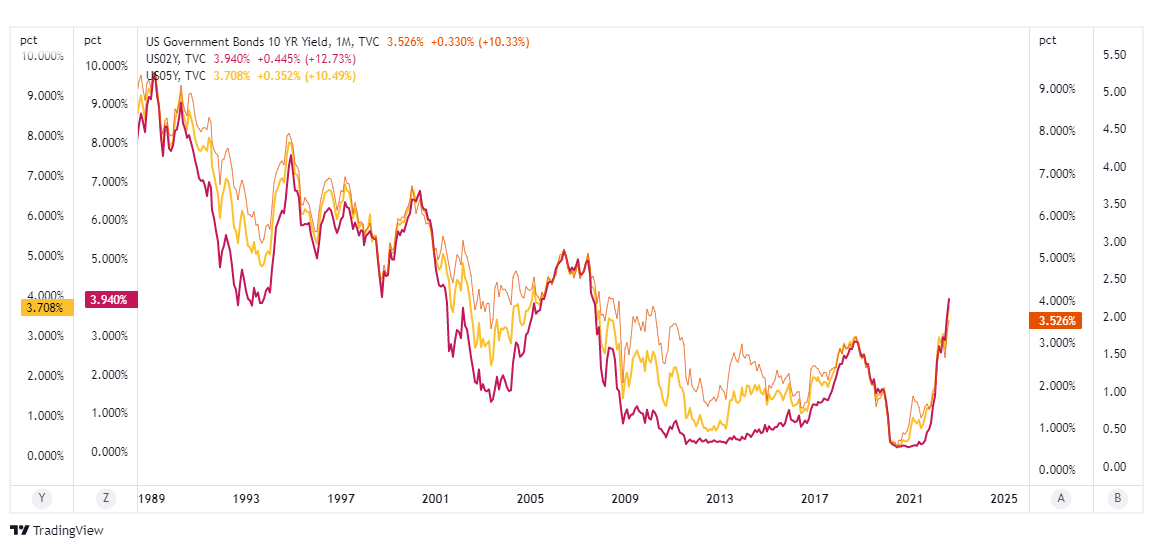

Yield charts for 10-, 5-, and 2-year US Treasury bonds.

Moreover, bond yield is closely dependent on, among other things, what interest rates investors expect in the near future (rising interest rates, in turn, increase demand for the currency). Therefore , during the Fed’s recent monetary policy shift at the turn of 2021-2022, yield rose before any real increases occurred , as these were anticipated by the market.

Bond Spread and Forex Rate Prediction

The current yield on government bonds can be used to predict future exchange rates on the Forex market. We are talking here more specifically about yield spreads, i.e. the difference between the “Yields” of two different countries.

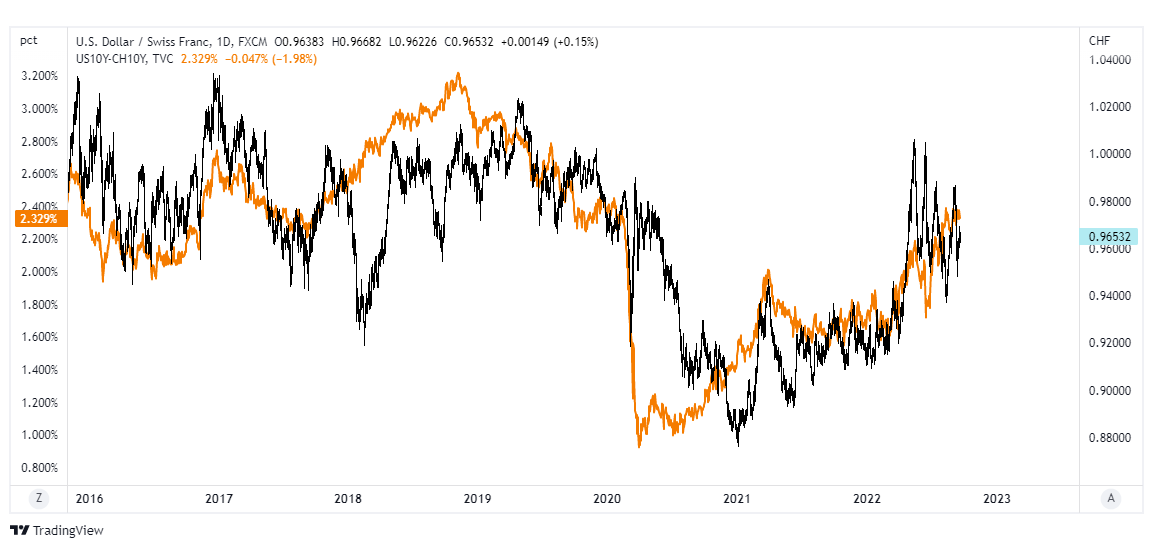

For example, we have the USD/CHF pair.

If interest rates in Switzerland remain at 0%, and the US is expected to tighten monetary policy and raise interest rates, demand for the dollar will also increase. Investors will sell Swiss francs and buy dollars instead, for example, to invest in US bonds, which offer higher yields.

Below you see the USD/CHF pair and the yield spread between US and Swiss 10-year Treasury bonds (US10Y-CH10Y – orange). Notice that as the spread has widened in favor of US bonds since the start of 2021, the dollar has strengthened against the Swiss franc , and the USD/CHF pair is in an uptrend.

Why? Investors exchange Swiss francs for dollars because, among other things, government bonds, classified as fixed-income securities (FIS), offer higher yields than Swiss bonds . Another reason is the Carry Trade, a popular strategy that involves borrowing the currency of a country with low interest rates to buy the currency of one offering higher yields.

Cross-market analysis is just a tool – how you use it is up to you

Unfortunately, there is no single, mechanical way to use the above tools.

When monitoring yields, several different scenarios should be considered, including one in which, for example, Wall Street stock prices decline and investors go into risk-off mode, seeking refuge in US bonds. Higher demand will push their yield lower, which in turn will reduce demand for the dollar.

Therefore, instead of focusing on correlations between instruments, it’s important to understand that observing them is merely a means to an end. The goal is to find an answer to a seemingly simple question: “where should money flow in the current economic climate?”

Fundamental analysis on Forex and time frames

This also explains the fact that observing long-term trends in currency pairs and bond yields is not only beneficial for investors.

It will prove useful even if you’re a short-term trader, assuming you hold positions for one to several days. Why? Because from the perspective of the average technical trader, the price of an instrument can rise or fall, and they typically open positions in both directions , depending on the chart situation.

Enriching the analysis with the basics of macroeconomics allows us to exclude one of the options and focus only on buying/selling the currency , looking for those transaction signals that are consistent with the fundamental context .